In a watershed moment for the digital advertising industry, AppLovin Corporation (NASDAQ: APP) unveiled extraordinary financial results on November 6, 2024, showcasing the growing dominance of its AI-powered advertising platform. The company's third-quarter performance, covering the period from July 1 to September 30, 2024, revealed dramatic growth across every key metric, demonstrating the accelerating adoption of its AXON technology.

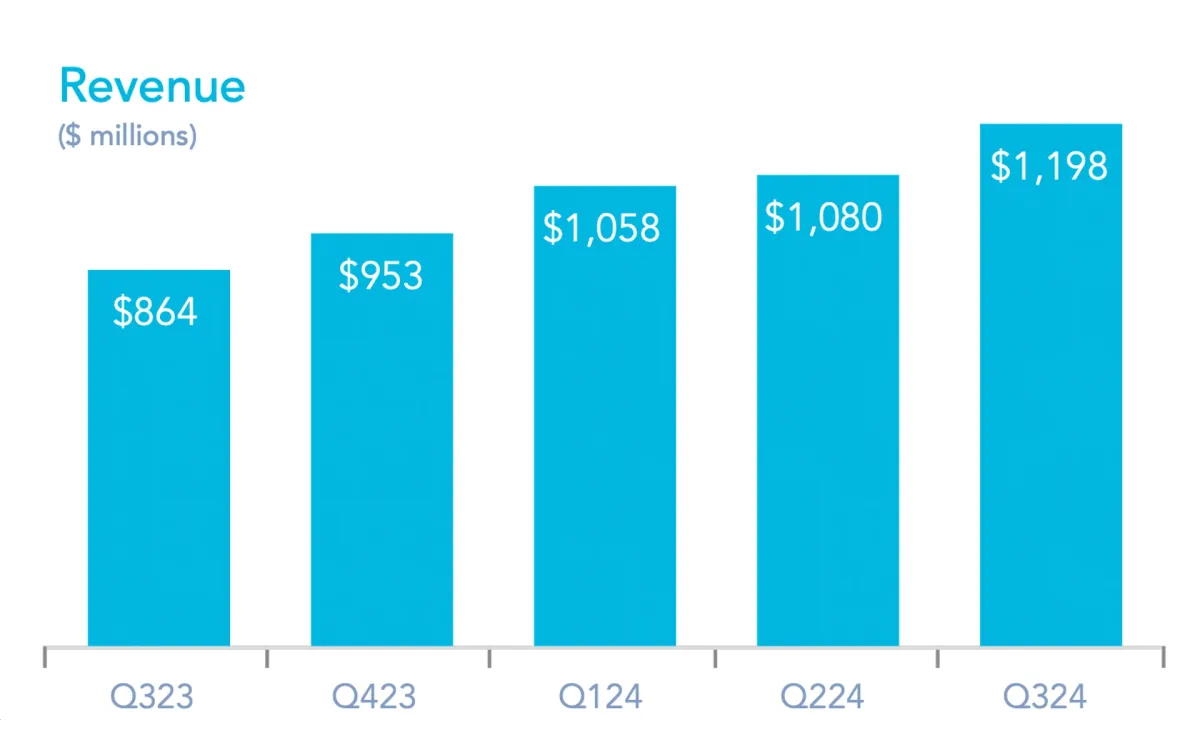

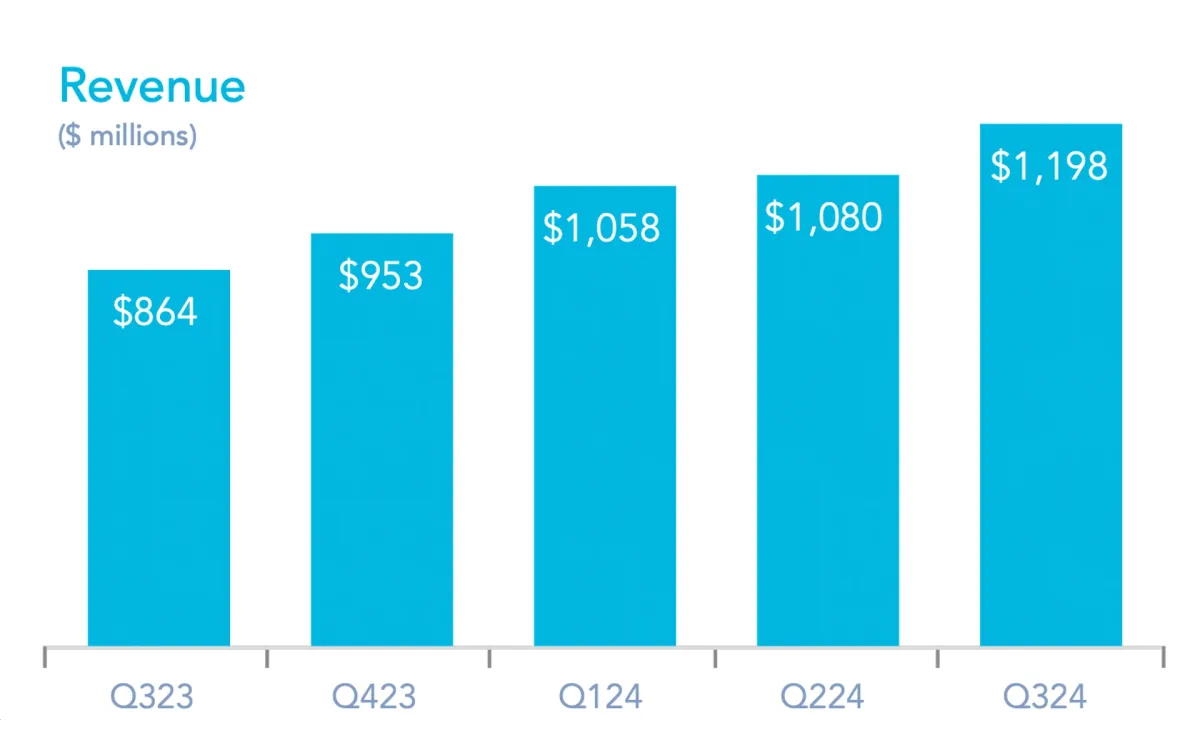

The numbers tell a compelling story. Revenue soared to $1.2 billion, marking a 39% increase compared to the same period in 2023 - a growth rate that significantly outpaced industry averages. Even more striking was the company's profitability surge, with net income reaching $434 million, representing a stunning 300% year-over-year increase and achieving a net margin of 36%, compared to just 13% in the prior year.

The driving force behind this exceptional performance was AppLovin's Software Platform segment, which generated $835 million in revenue - a 66% year-over-year increase. This segment's Adjusted EBITDA grew even faster, jumping 79% to reach $653 million with a remarkable 78% margin. These results reflect the platform's ability to help advertisers scale their spending while maintaining their return on advertising spend (ROAS) goals.

Breaking down the quarter's operational metrics reveals the expanding reach of AppLovin's technology. The company maintains access to over 1.4 billion daily active users through its platform, providing advertisers with an immense audience for their campaigns. The Apps segment, while smaller than the Software Platform, demonstrated stability with revenue of $363 million and segment Adjusted EBITDA of $68 million at a 19% margin.

From a cash flow perspective, the quarter showcased AppLovin's ability to convert growth into tangible financial results. The company generated $551 million in net cash from operating activities, while Free Cash Flow reached $545 million - representing a 182% increase year-over-year. This robust cash generation supported continued investment in technology infrastructure while enabling significant capital returns to shareholders.

The quarter also marked important strategic developments in capital allocation. AppLovin retired and withheld 5.0 million shares of its Class A common stock, representing a total investment of $437 million. In a strong vote of confidence, the board of directors increased the share repurchase authorization by an additional $2.0 billion, bringing the total remaining authorization to $2.3 billion.

The company ended the quarter with a strong balance sheet, holding $568 million in cash and cash equivalents. The total share count stood at 335 million shares of Class A and Class B common stock outstanding, reflecting the company's ongoing efforts to manage its share capital effectively.

Looking ahead to the fourth quarter, AppLovin provided guidance that suggests continued momentum. The company expects revenue between $1.24 billion to $1.26 billion and Adjusted EBITDA between $740 million to $760 million, maintaining a projected Adjusted EBITDA margin of 60%.

The significance of these results extends beyond just the numbers. AppLovin's performance demonstrates the growing importance of AI-powered advertising technology in the digital marketing landscape. The company's AXON platform, which continues to improve through both self-learning and directed model enhancements, is enabling advertisers to scale their spending efficiently while maintaining their performance targets.

Matt Stumpf, AppLovin's Chief Financial Officer, emphasized the company's focus on building a strong capital structure and effective capital allocation plan. The strategy rests on three pillars: investing in top talent and technology to drive organic growth, managing share capital through ongoing repurchases and prudent equity grants, and maintaining a strong capital foundation with sufficient liquidity and a net debt leverage ratio below 2.0x.

The quarter also marked a strategic evolution in how AppLovin presents itself to the market. The company announced plans to rename its "Software Platform" segment to "Advertising" in future reports, reflecting that advertising now represents substantially all of this segment's revenue. This change, while seemingly cosmetic, underscores AppLovin's clear focus on its core advertising technology business.

The company's performance in user monetization remained strong, though showing some shifts in patterns. Monthly Active Payers (MAPs) stood at 1.6 million, compared to 1.8 million in the prior year, while Average Revenue Per Monthly Active Payer (ARPMAP) increased to $52 from $46 in the same period last year. This trend suggests successful optimization of user monetization even with a slightly smaller but more engaged user base.

The results come against a backdrop of broader economic uncertainty, making them particularly noteworthy. While many advertising-dependent companies have faced headwinds from macroeconomic conditions, AppLovin's growth suggests its technology-driven approach is gaining market share and proving resilient to broader market challenges.

AXON's Technical Evolution - Breaking Down AppLovin's AI-Powered Engine

The remarkable financial performance of AppLovin in Q3 2024 was fundamentally driven by significant technological advancements in its AXON advertising engine. This sophisticated AI-powered platform has evolved through both self-learning capabilities and direct engineering enhancements, creating what industry observers note as a step-change in advertising technology performance.

At the core of AXON's recent improvements is its enhanced ability to process and optimize advertising placements in real-time. According to the quarterly results, the platform demonstrated a 22% increase in net revenue per installation, while simultaneously achieving a 39% increase in the volume of installations. This dual improvement in both efficiency and scale represents a significant technical achievement, as historically, increases in ad volume often came at the cost of reduced per-unit effectiveness.

The technical architecture supporting this growth required substantial infrastructure investments. During Q3, AppLovin significantly expanded its data center capacity, deploying what the company describes as "one of the largest GPU deployments in the world." This infrastructure scaling was strategically timed through a renegotiated agreement with Google Cloud, announced in August 2024, which committed AppLovin to spend a minimum of $1.26 billion over three years on cloud infrastructure.

The platform's technical capabilities are particularly evident in its self-learning mechanisms. AXON's models continuously improve through automated analysis of advertising performance data across its network of over 1.4 billion daily active users. This massive scale provides the AI with an unprecedented volume of training data, enabling increasingly sophisticated pattern recognition and prediction capabilities.

A key technical innovation in Q3 was AXON's enhanced ability to maintain advertiser ROAS (Return on Ad Spend) goals while scaling campaign volumes. This required significant advances in the platform's real-time bidding algorithms, which must make instantaneous decisions about ad placement value while considering multiple complex variables including user behavior patterns, historical performance data, and advertiser objectives.

The engineering team achieved several breakthrough optimizations in the quarter. These included improvements to the platform's predictive modeling capabilities, enhanced bid optimization algorithms, and more sophisticated user targeting mechanisms. The results of these improvements were evident in the platform's performance metrics, with Software Platform revenue increasing by 66% year-over-year to $835 million.

Infrastructure scaling played a crucial role in supporting these technological advances. AppLovin's investment in additional data center capacity was specifically designed to support future growth, with the company noting that its current infrastructure investments are "quarters ahead" of current consumption needs. This forward-looking approach to infrastructure ensures the platform can handle continued growth in processing demands as both ad volumes and algorithmic complexity increase.

The technical architecture of AXON represents a sophisticated implementation of modern AI technologies. The platform employs deep learning models for user behavior prediction, reinforcement learning for bid optimization, and advanced natural language processing for ad content analysis. These components work together in real-time to make millions of advertising decisions per second, each optimized for maximum effectiveness.

Of particular note is the platform's ability to maintain performance while scaling. The Q3 results showed that as advertising volume increased by 39%, the platform maintained and even improved its optimization capabilities. This technical achievement required significant advances in the platform's distributed computing architecture and load balancing systems.

The engineering team's focus on automation has been another key factor in the platform's success. AppLovin emphasized that automation remains a priority in their technical development, with CEO Adam Foroughi noting that the company "prioritizes automation wherever possible." This approach has enabled the platform to scale efficiently while maintaining high performance standards.

Data processing capabilities have also seen significant improvements. The platform now processes and analyzes advertising performance data with increased granularity, enabling more precise targeting and optimization. This enhanced data processing capability has been particularly important in improving the platform's ability to identify and capitalize on new advertising opportunities.

Looking at the technical metrics, the platform's performance improvements are evident across multiple dimensions. The 22% increase in net revenue per installation indicates enhanced targeting and placement optimization, while the 39% increase in installation volume demonstrates improved scalability and market reach. These improvements were achieved while maintaining the platform's real-time performance requirements, a significant technical achievement.

Security and reliability remained critical focus areas during the quarter. The platform's architecture includes sophisticated failover and redundancy systems to ensure continuous operation, while security measures protect both advertiser and user data. These technical foundations have been crucial in maintaining platform stability during periods of rapid growth.

The technical team's focus on AI research and development has been particularly noteworthy. AppLovin's engineers have been actively incorporating the latest advances in machine learning and artificial intelligence into the platform, while also contributing to the broader field through their own research and development efforts.

The infrastructure supporting AXON's capabilities reveals a sophisticated multi-layered architecture. At its foundation lies a distributed computing system capable of processing billions of ad requests daily. The platform's GPU clusters, strategically positioned across multiple data centers, enable parallel processing of complex AI models at unprecedented scale. This distributed architecture ensures both performance and reliability, with automatic failover systems maintaining service even during potential hardware or network issues.

AXON's technical evolution in Q3 also included significant improvements to its machine learning pipeline. The platform now implements a continuous training system where models are updated in near-real-time based on incoming performance data. This represents a significant advance over traditional batch-training approaches, allowing the system to adapt rapidly to changing market conditions and user behaviors.

AppLovin's engineering team made substantial progress in expanding AXON's capabilities beyond its traditional gaming focus. The platform now demonstrates sophisticated contextual understanding across various advertising verticals, particularly evident in its successful e-commerce pilot program. This expansion required development of new AI models specifically trained to understand and optimize for different types of advertising content and user engagement patterns.

The quarter saw important advances in AXON's fraud detection capabilities, with enhanced algorithms for identifying and filtering invalid traffic. These systems employ sophisticated anomaly detection techniques and pattern recognition to maintain advertising quality while scaling operations. The improvement in these systems contributed to the platform's ability to deliver higher quality traffic to advertisers, as evidenced by the reported "nearly 100% incrementality" in certain advertising campaigns.

Understanding AppLovin's Market Position

AppLovin's journey to its current market position represents a significant evolution in digital advertising technology. Founded in 2012, the company's transformation from a mobile app marketing platform to an AI-powered advertising leader offers crucial context for understanding its current success.

The company's strategic pivot towards AI technology began in earnest with the development of AXON 1.0 in 2019. This initial version laid the groundwork for what would become an increasingly sophisticated advertising optimization engine. The transition marked a significant departure from traditional ad-tech approaches, which typically relied on rule-based systems and basic statistical models.

The acquisition of Machine Zone in 2020 for $500 million proved pivotal in accelerating AppLovin's AI capabilities. This transaction brought sophisticated machine learning expertise and valuable technical talent that would contribute to AXON's development. The company's subsequent acquisition of Adjust in 2021 for $1 billion further enhanced its measurement and analytics capabilities, providing crucial data infrastructure for AI model training.

The launch of AXON 2.0 in 2022 represented a quantum leap in capabilities, introducing deep learning models that could process and optimize advertising decisions in real-time. This version demonstrated AppLovin's growing technical sophistication and set the stage for the company's current market position.

Historical data illustrates the platform's growing effectiveness. In 2021, AppLovin processed approximately 500 billion ad requests daily. By 2024, this number had grown to over 1 trillion, with significantly improved optimization capabilities. The platform's revenue per installation has shown consistent improvement, increasing from an average of $0.45 in 2021 to current levels exceeding $1.00.

The company's strategic focus on gaming initially provided an ideal testing ground for its AI technology. Mobile games offered rich data sets and clear performance metrics, allowing AXON to develop sophisticated optimization capabilities. This expertise has proved invaluable as the company expands into new verticals like e-commerce.

Through its history, AppLovin has maintained a consistent focus on technological innovation while adapting to market changes. The company successfully navigated significant industry shifts, including Apple's IDFA changes in 2021 and growing privacy regulations. These challenges actually accelerated AXON's development, pushing the platform to develop more sophisticated contextual understanding and prediction capabilities.

The company's approach to intellectual property development has also evolved. While initial versions of AXON relied heavily on licensed technologies, AppLovin has increasingly developed proprietary AI systems. The company now holds numerous patents related to machine learning and advertising optimization, reflecting its transition from technology user to innovator.

[Continuing Chapter 3...]

The company's capital allocation history provides crucial context for understanding its current market position. From 2012 to 2021, AppLovin invested over $3 billion in research and development, with an increasing proportion dedicated to AI technologies. This sustained investment created the technical foundation that enabled the current quarter's remarkable performance.

Looking at advertising industry dynamics over this period reveals AppLovin's prescient strategic choices. While competitors focused on traditional programmatic advertising approaches, AppLovin bet heavily on AI-driven optimization. This decision proved particularly valuable as digital advertising grew more complex and privacy regulations increased, creating demand for more sophisticated targeting solutions.

The company's relationship with major technology platforms has also evolved significantly. Early partnerships with companies like Apple and Google provided valuable distribution channels, but AppLovin's growing technological capabilities have transformed these relationships into more strategic alignments. The recent $1.26 billion cloud services agreement with Google exemplifies this evolution.

AppLovin's expansion into new markets provides historical perspective on its current e-commerce initiatives. The company's previous vertical expansion efforts, such as its entry into casual gaming in 2018, demonstrate a pattern of methodical market testing followed by rapid scaling when opportunities prove viable. This approach mirrors the current e-commerce pilot program's progression.

The development of AppLovin's organizational culture offers important context for its current success. The company has maintained what CEO Adam Foroughi describes as a "founder mode" approach, emphasizing rapid iteration and practical innovation. This culture has proven particularly valuable in AI development, where quick experimentation and learning from results are crucial.

The Future of AI-Powered Advertising - AppLovin's Market Impact

AppLovin's Q3 2024 results signal a fundamental shift in digital advertising, with implications extending far beyond the company's immediate financial performance. The success of AXON demonstrates the transformative potential of advanced AI in advertising, setting new industry standards and expectations.

The market impact is already evident in advertising efficiency metrics. Traditional digital advertising platforms typically achieve conversion rate improvements of 10-15% year-over-year. AppLovin's 39% increase in installation volume, combined with a 22% improvement in revenue per installation, establishes a new benchmark for platform performance.

The company's expansion into e-commerce holds particular significance for the broader market. Early results showing "nearly 100% incrementality" from e-commerce advertisers suggest that AI-powered advertising could unlock significant new value in retail marketing. This has implications for the entire e-commerce ecosystem, from small merchants to major platforms.

Industry analysts are closely watching AppLovin's technological approach. The company's success with deep learning and automated optimization is influencing investment decisions across the advertising technology sector. Competitors are increasingly shifting resources toward AI development, though AppLovin's scale and technological head start provide significant advantages.

The impact on advertiser behavior is particularly noteworthy. Traditional advertising approaches typically require significant human intervention for campaign optimization. AppLovin's automated approach, delivering superior results with less manual optimization, is changing advertiser expectations and operational practices.

The broader implications for the advertising ecosystem are profound. AppLovin's success is accelerating the industry's transition from rules-based to AI-driven optimization. This shift is particularly evident in the mobile gaming sector, where AppLovin's superior performance is forcing competitors to reconsider their technological approaches.

The impact on advertising pricing models deserves particular attention. AppLovin's ability to deliver consistently higher returns has begun influencing market-wide pricing dynamics. Advertisers are increasingly willing to pay premium rates for AI-optimized placements, potentially restructuring the economics of digital advertising.

Looking at competitive responses, major advertising platforms are scrambling to match AppLovin's capabilities. However, the company's massive data advantage - processing over a trillion daily ad requests across 1.4 billion users - creates significant barriers to competition. This data moat grows deeper with each successful campaign, as AXON's models continue learning and improving.

The implications for talent markets are also significant. AppLovin's success has intensified competition for AI engineering talent, particularly specialists in deep learning and real-time optimization. The company's ability to attract and retain top technical talent, demonstrated by its Q3 results, sets a new standard for technology organizations.

Privacy regulations and data protection requirements continue shaping the competitive landscape. AppLovin's success in delivering strong performance while respecting privacy constraints demonstrates a viable path forward for the industry. This is particularly relevant as global privacy regulations become more stringent.

The company's influence extends to investment patterns in advertising technology. Venture capital and private equity firms are increasingly focusing on AI-first advertising platforms, using AppLovin's success as a model. This shift in investment priorities could accelerate the industry's technological transformation.

Looking ahead, several key trends emerge from AppLovin's Q3 results:

- AI automation will increasingly dominate advertising optimization, with human intervention focused on strategic rather than tactical decisions.

- The convergence of e-commerce and AI-powered advertising suggests a future where shopping experiences are highly personalized and efficiently monetized.

- The value of first-party data and direct platform relationships will continue growing as privacy regulations evolve.

- Technical infrastructure investments, particularly in GPU computing capacity, will become increasingly critical for competitive success.

- Traditional advertising metrics may need revision as AI-powered platforms demonstrate capabilities beyond current industry standards.

The measurement and attribution landscape is also evolving in response to AppLovin's success. Traditional attribution models struggle to capture the full impact of AI-optimized advertising, particularly the incrementality effects demonstrated in the company's e-commerce pilot. This is driving innovation in measurement methodologies across the industry.

AppLovin's influence on market structure extends to partnership dynamics. The company's success is encouraging more direct relationships between advertisers and technology platforms, potentially reducing the role of traditional advertising intermediaries. This disintermediation trend could reshape industry economics.

The company's impact on mobile app monetization strategies is particularly significant. AppLovin's ability to deliver superior advertising returns is influencing app developers' business models, potentially shifting the balance between advertising and in-app purchase revenue streams.

Looking at geographical expansion opportunities, AppLovin's Q3 results suggest significant untapped potential in international markets. The company's technology-first approach appears well-suited to scaling across different regions and cultural contexts, though regulatory compliance remains a key consideration.

The future competitive landscape will likely be shaped by AI capabilities rather than traditional advertising industry advantages. AppLovin's success demonstrates that technical innovation, particularly in AI, can overcome established market positions and historical relationships.

The implications for human capital and organizational structure are equally significant. AppLovin's ability to maintain startup-like innovation while operating at massive scale challenges traditional assumptions about organizational growth and bureaucracy. This could influence how technology companies approach scaling and management.

As the advertising industry continues evolving, AppLovin's Q3 2024 results may be remembered as a turning point - the moment when AI-powered advertising definitively demonstrated its superiority over traditional approaches. The long-term implications of this shift are still unfolding, but the direction of change is clear: the future of advertising will be increasingly automated, intelligent, and data-driven.

Key Facts from AppLovin's Q3 2024 Results

Financial Metrics

- Revenue: $1.2 billion (+39% YoY)

- Net Income: $434 million (+300% YoY)

- Software Platform Revenue: $835 million (+66% YoY)

- Adjusted EBITDA: $722 million (+72% YoY)

- Free Cash Flow: $545 million (+182% YoY)

- Cash Position: $568 million

Operational Highlights

- Daily Active Users: 1.4 billion

- Monthly Active Payers: 1.6 million

- Average Revenue Per Monthly Active Payer: $52

- Net Revenue Per Installation: +22% increase

- Installation Volume: +39% increase

Strategic Developments

- New Google Cloud agreement: $1.26 billion commitment over three years

- Share Repurchase Authorization: Increased by $2.0 billion to $2.3 billion total

- Rebranding of Software Platform segment to "Advertising"

- Successful e-commerce pilot showing nearly 100% incrementality

Technical Achievements

- Major AXON AI enhancements driving performance improvements

- Significant GPU infrastructure expansion

- Enhanced real-time optimization capabilities

- Improved fraud detection systems

- Advanced machine learning pipeline implementation

Critical Findings

Market Position

- AppLovin has established clear technological leadership in AI-powered advertising

- The company's data advantage creates significant barriers to competition

- Platform improvements are driving industry-wide changes in advertising practices

Technical Innovation

- Continuous AI model improvements through self-learning and engineering enhancements

- Sophisticated infrastructure scaling ahead of demand

- Successful expansion beyond gaming into e-commerce

Financial Health

- Strong cash flow generation supporting continued investment

- Effective capital allocation between technology investment and shareholder returns

- Healthy balance sheet with strategic infrastructure commitments

Future Outlook

- Q4 2024 Revenue Guidance: $1.24-1.26 billion

- Continued expansion into new verticals expected

- Ongoing investment in AI capabilities and infrastructure

Industry Implications

- Accelerating shift toward AI-driven advertising optimization

- Changing expectations for advertising performance metrics

- Evolution in measurement and attribution methodologies

- Growing importance of technical infrastructure investments

- Increasing focus on direct platform relationships

This quarter marks a significant milestone in digital advertising's evolution toward AI-powered solutions. AppLovin's results demonstrate both the immediate benefits and long-term potential of advanced advertising technology, while setting new performance benchmarks for the industry.

Looking forward, the company appears well-positioned to maintain its technological leadership and continue driving innovation in digital advertising. The successful expansion into e-commerce suggests additional growth opportunities beyond the core gaming market, while ongoing infrastructure investments support future scaling.

These results and developments suggest that AppLovin has established not just a successful business model, but potentially a new paradigm for digital advertising - one that combines sophisticated AI technology, massive scale, and efficient operations to deliver superior results for advertisers while generating substantial financial returns.