On November 10, 2011, Rikard Lindquist, a Finance Manager for Strategic Partnerships at Google, forwarded an internal email containing a presentation about the display advertising ecosystem. This document, now part of a court case against Google (Case 1:23-cv-00108-LMB-JFA), provides insight into how Google viewed the evolution of display advertising at that time.

The presentation, titled Display Ecosystem Boot Camp, outlines the progression of display advertising from its early days to the emergence of real-time bidding and ad exchanges. It offers a comprehensive look at the various players and technologies that shaped the industry over time.

According to the document, display advertising initially operated through direct sales between publishers and advertisers or agencies. This model, known as reservation or direct buy, involved advertisers purchasing inventory directly from a publisher's sales force with agreed-upon impression goals, budgets, and campaign dates.

As the industry grew, publishers faced challenges with unsold inventory, referred to as "remnant" inventory. This led to the rise of ad networks, which aggregated publisher ad space and sold it to advertisers seeking to reach a broader audience. The presentation mentions several prominent ad networks of the time, including Advertising.com and Glam Media.

However, the ad network model had its drawbacks. The document cites issues such as lack of transparency, proliferation of networks, daisy-chaining (where networks resold inventory to other networks), and arbitrage (buying low and selling high without adding value).

To address these challenges, yield managers emerged. Companies like Rubicon, Admeld, and PubMatic offered services to manage relationships with multiple ad networks on behalf of publishers. Their goal was to increase overall yield by optimally allocating available impressions among buyers.

The presentation then introduces the concept of ad exchanges, describing them as auction-driven technology platforms that enable the buying and selling of ad inventory. Google's DoubleClick Ad Exchange, Microsoft Advertising Exchange, and Yahoo's Right Media are mentioned as examples.

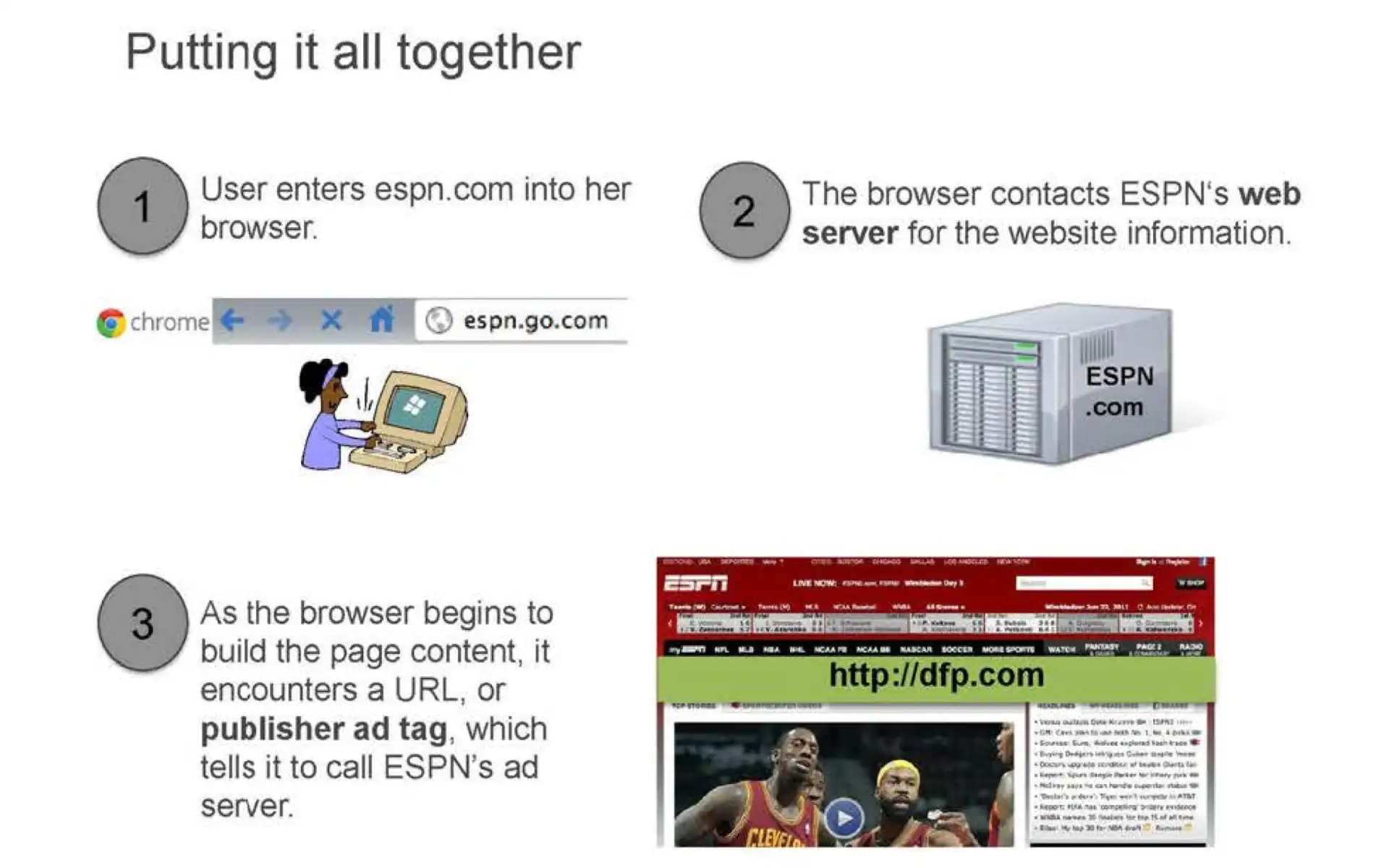

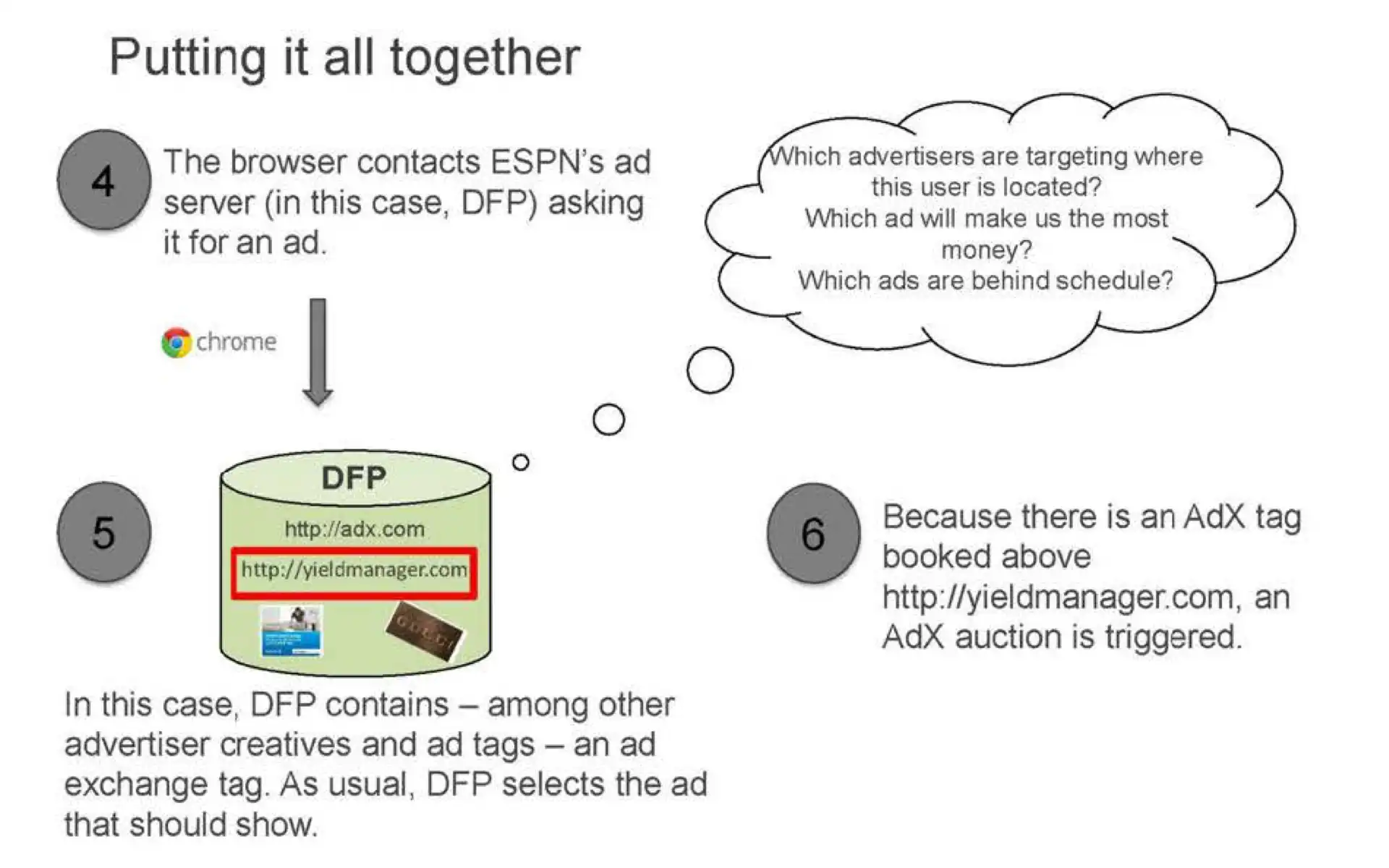

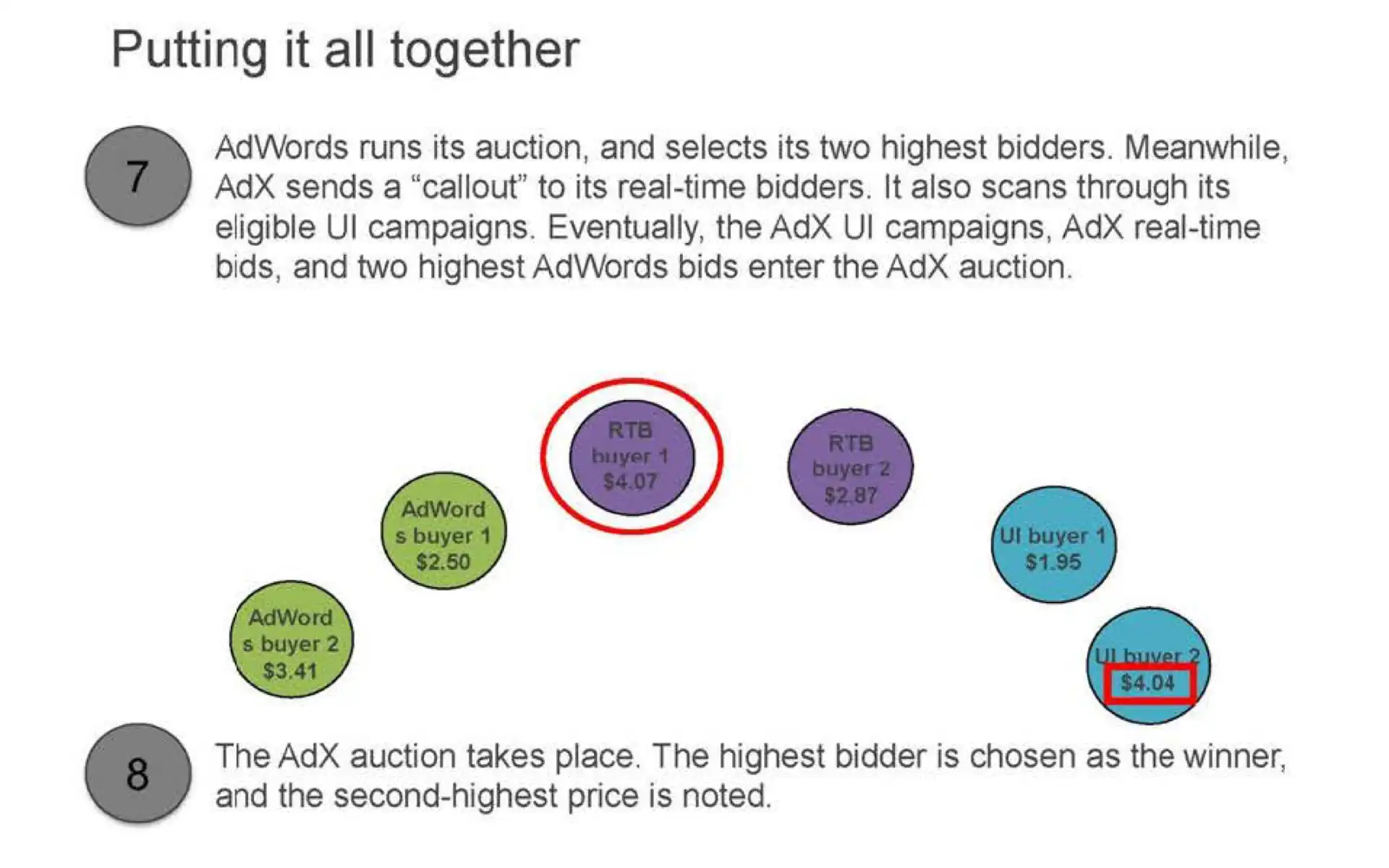

The document provides a detailed explanation of how Google's DoubleClick Ad Exchange (AdX) operated. It describes the process of sellers making inventory available, buyers creating targeted campaigns, and the auction mechanism that matches inventory to the highest bidder in real-time.

Two primary methods for buying on AdX are outlined: through a user interface (UI) similar to AdWords, and via real-time bidding (RTB). RTB is explained as a feature allowing buyers to analyze each impression in real-time and submit bids based on their own algorithms and data.

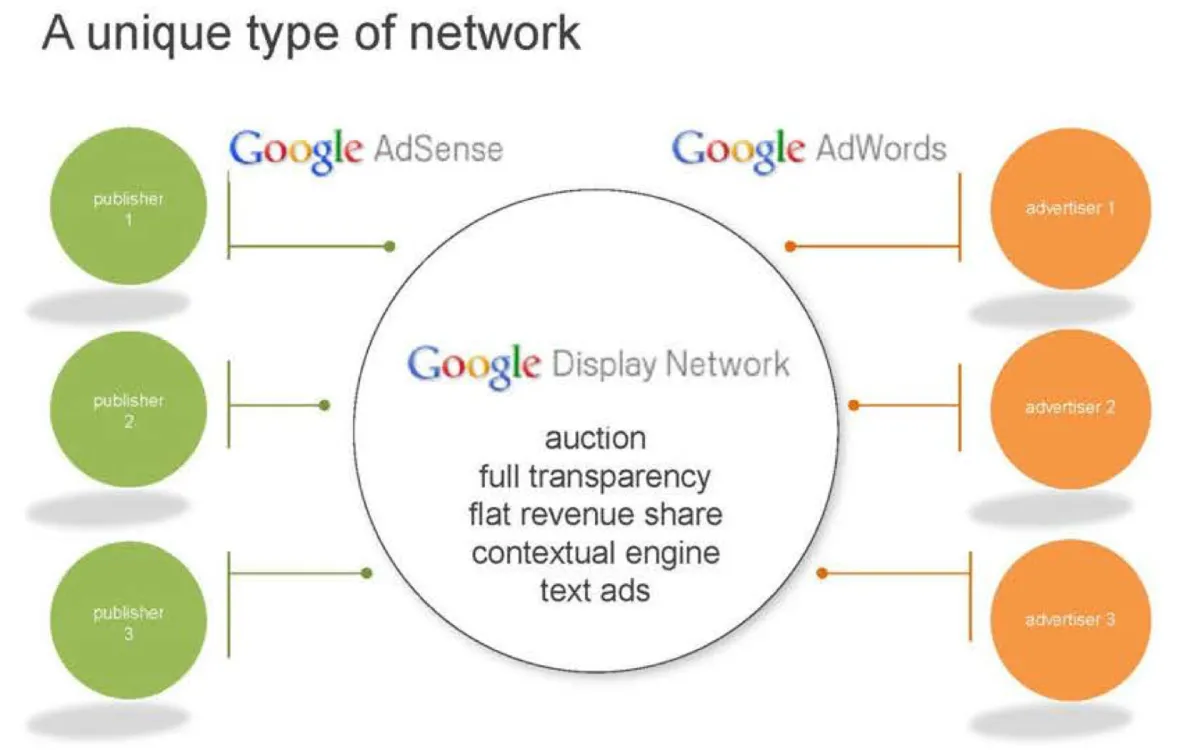

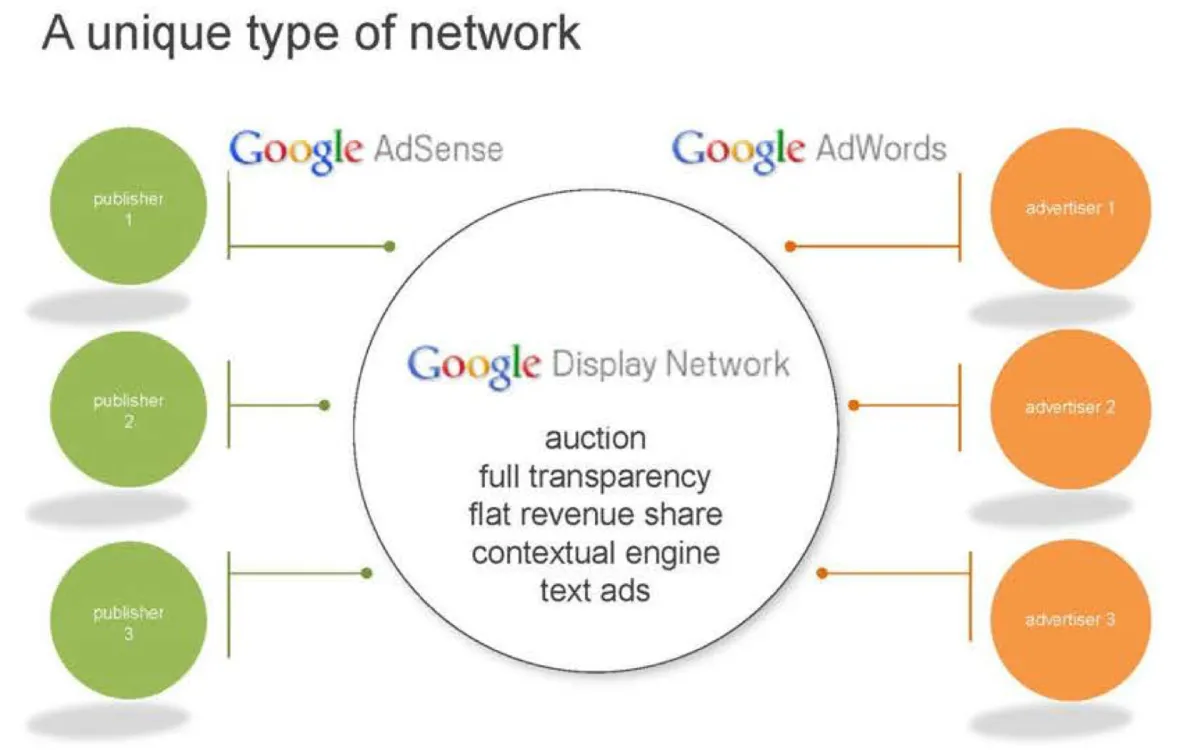

The presentation also touches on the integration between AdX and Google's AdSense and AdWords products, explaining how these systems interact in the auction process.

As RTB grew in popularity, new types of companies emerged in the ecosystem. The document mentions trading desks (divisions within agency holding companies managing exchange buying), demand-side platforms (DSPs) like MediaMath and Turn, and audience data companies such as eXelate and BlueKai.

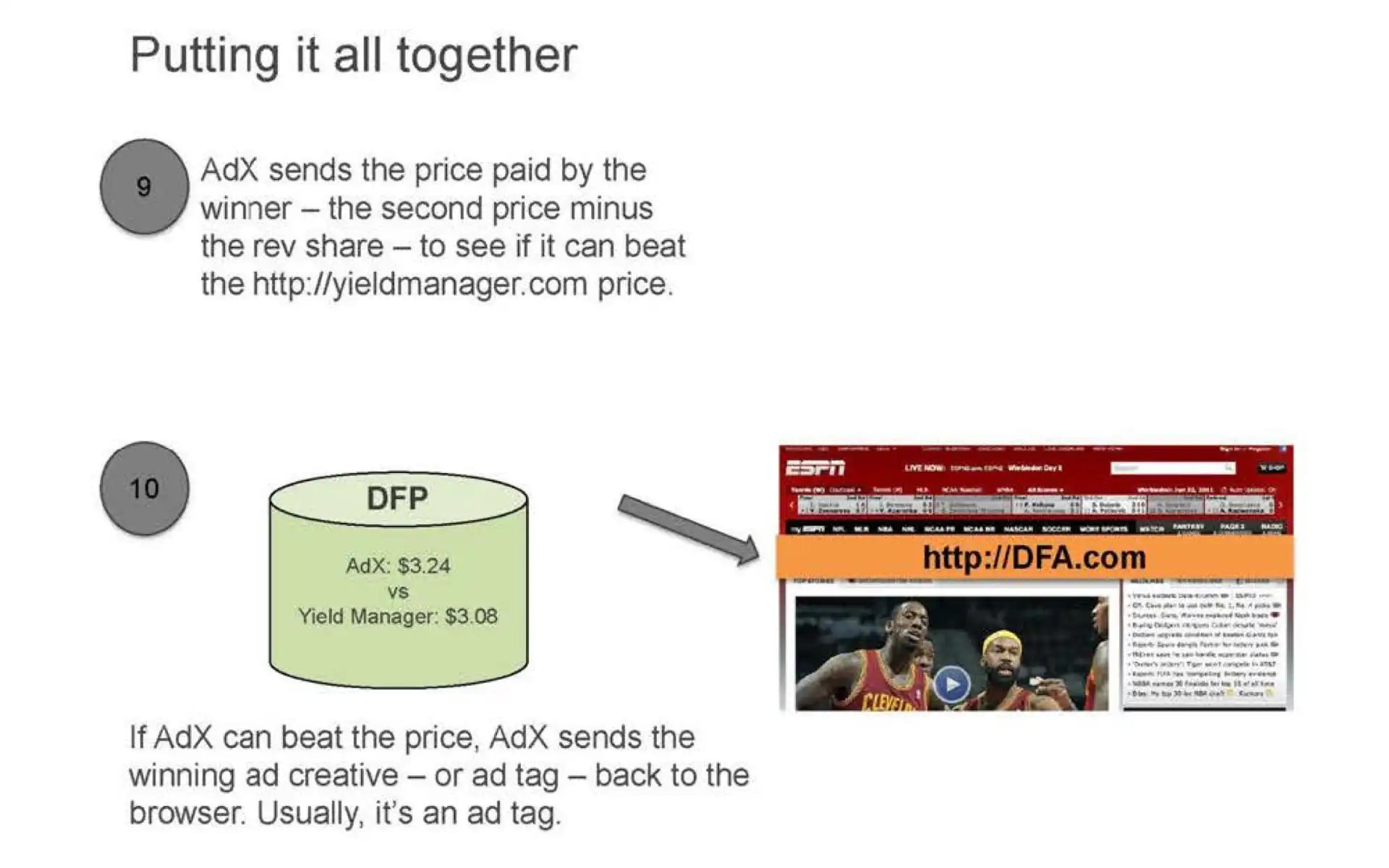

The presentation concludes by explaining some publisher-focused features of AdX, including the ability to keep inventory anonymous to protect direct sales channels and "dynamic allocation," a yield maximization feature in DoubleClick for Publishers (DFP) that compares AdX bids to other demand sources in real-time.

Key facts from the presentation

The document is dated November 10, 2011

It was forwarded by Rikard Lindquist, a Finance Manager for Strategic Partnerships at Google

The presentation covers the evolution from direct ad sales to real-time bidding exchanges

Ad networks, yield managers, and ad exchanges are presented as successive solutions to industry challenges

Google's DoubleClick Ad Exchange is described in detail, including its auction mechanism and buying methods

The emergence of trading desks, DSPs, and audience data companies is noted as a result of RTB growth

Publisher features like anonymity options and dynamic allocation are explained