fuboTV Inc., a leading sports-first live TV streaming platform, this month announced its financial results for the second quarter of 2024. The company reported significant growth in revenue and subscribers, marking its sixth consecutive quarter of global year-over-year improvement in profitability metrics.

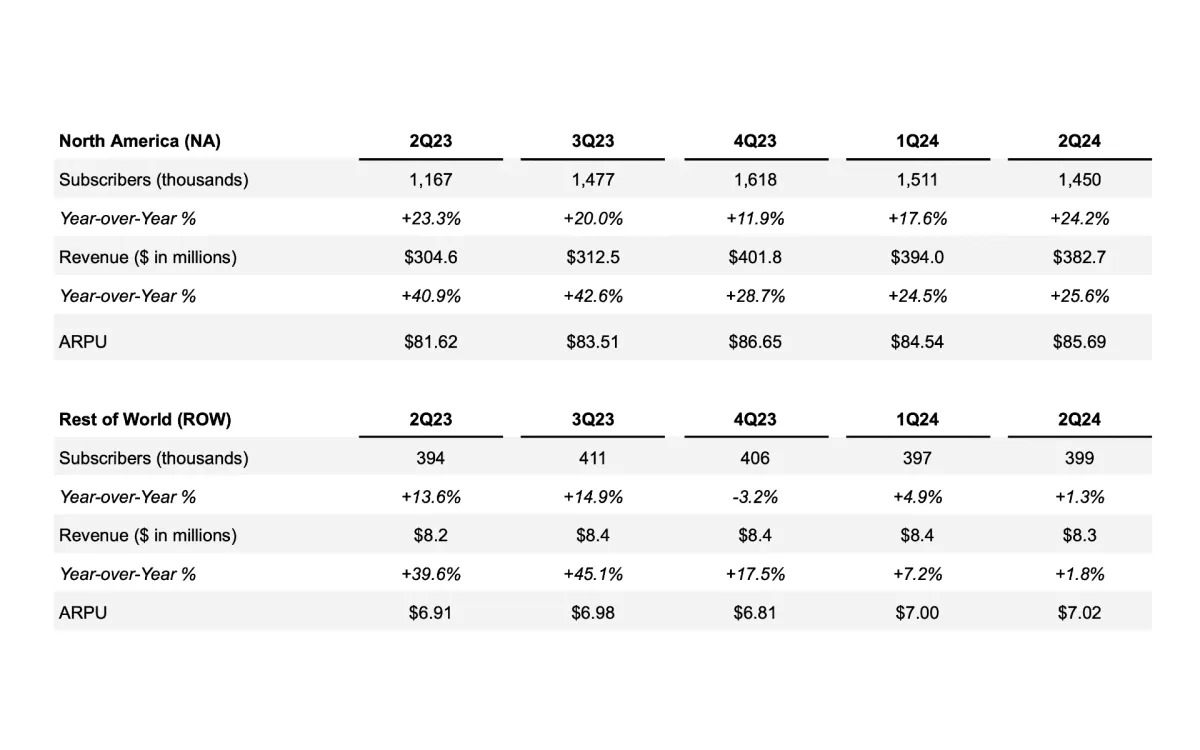

According to the earnings report, fuboTV's North American operations exceeded expectations, with total revenue reaching $382.7 million, a 26% increase compared to the same period last year. The company's paid subscriber base in North America grew to 1.45 million, representing a 24% year-over-year increase.

The advertising business also showed strength, with ad revenue rising to $26.3 million, a 14% year-over-year increase. This growth occurred despite a challenging advertising market, demonstrating fuboTV's ability to attract advertisers in the sports streaming segment.

FuboTV's CEO, David Gandler, emphasized the company's focus on delivering value and expanding relevance to consumers in a rapidly changing environment. He highlighted the launch of the Fubo Free Tier, a new offering that provides nearly 200 free ad-supported streaming television channels to certain former paid and free trial subscribers.

The company's financial performance showed notable improvements in several key areas. The net loss for the quarter was $25.8 million, a significant reduction from the $54.2 million loss reported in the second quarter of 2023. This improvement resulted in a per-share loss of $0.08, compared to a loss of $0.19 in the same period last year.

Adjusted EBITDA, a key measure of profitability, improved by $19.6 million year-over-year to negative $11 million. The adjusted EBITDA margin also saw substantial improvement, reaching negative 2.8% compared to negative 9.8% in the prior year period.

FuboTV's CFO, John Janedis, noted that these results demonstrate the company's potential and resilience, putting it in a strong position to achieve its profitability objectives. The company's efforts to identify efficiencies and maximize leverage across the business resulted in a $40.5 million year-over-year improvement in free cash flow.

The company also took steps to strengthen its balance sheet during the quarter. FuboTV repurchased $46.9 million of convertible debt at an average price of 56.6% of par value, funded by issuing stock at $1.28 under its ATM program. This strategic move enhanced shareholder value by reducing outstanding debt and boosting financial flexibility.

Looking ahead, fuboTV provided guidance for the third quarter and full year 2024. For North America, the company expects third-quarter subscribers to range from 1.605 million to 1.625 million, representing 9% year-over-year growth at the midpoint. Third-quarter revenue is projected to be between $360 million and $370 million, a 17% year-over-year increase at the midpoint.

For the full year 2024, fuboTV raised its guidance for North America. The company now expects subscribers to reach 1.725 million to 1.745 million, representing 7% year-over-year growth at the midpoint. Full-year revenue is projected to be between $1.570 billion and $1.590 billion, an 18% year-over-year increase at the midpoint.

It's important to note that these projections do not account for any potential impact from the proposed sports streaming joint venture between Walt Disney Company, Fox Corporation, and Warner Bros. Discovery, now halted due to FuboTV's antitrust lawsuit.

The company's ongoing legal battle highlights the challenges and competitive pressures in the rapidly evolving streaming industry. FuboTV argues that the proposed joint venture could limit competition and lead to higher prices for consumers, similar to recent price increases seen in subscription video-on-demand services.

FuboTV's performance in the second quarter of 2024 demonstrates the company's ability to grow its subscriber base and revenue while making progress towards profitability. The launch of new features like the Fubo Free Tier and the company's focus on sports content continue to differentiate it in the crowded streaming market.

However, the company faces ongoing challenges, including intense competition, potential regulatory changes, and the need to continually invest in content and technology. The outcome of its antitrust lawsuit against major media companies could have significant implications for fuboTV's future growth and the broader streaming landscape.

As the streaming industry continues to evolve, fuboTV's performance in the coming quarters will be closely watched by investors and industry observers alike. The company's ability to maintain its growth trajectory while navigating legal and competitive challenges will be crucial to its long-term success.

Key facts

FuboTV reported Q2 2024 North American revenue of $382.7 million, up 26% year-over-year

North American paid subscribers reached 1.45 million, a 24% increase from Q2 2023

Advertising revenue grew 14% year-over-year to $26.3 million

Net loss improved to $25.8 million, compared to $54.2 million in Q2 2023

Adjusted EBITDA improved by $19.6 million year-over-year to negative $11 million

The company repurchased $46.9 million of convertible debt at 56.6% of par value

FuboTV raised its full-year 2024 guidance for North American subscribers and revenue

The company launched Fubo Free Tier, offering free ad-supported channels to certain former subscribers

FuboTV is engaged in an antitrust lawsuit against a proposed sports streaming joint venture