A recent report by DoubleVerify (DV), highlights the potential of retail media networks (RMNs) for advertisers. The findings, based on an analysis of over one trillion impressions from 2023, suggest that RMNs offer advantages in terms of brand suitability, ad fraud, and user engagement, despite some challenges with ad viewability.

RMNs are advertising platforms operated by retailers. They leverage the retailer's own customer data to target audiences with ads displayed on the retailer's website and app (owned & operated or O&O inventory) or across the web using audience extension. This approach allows advertisers to reach consumers at the point of purchase, a potentially powerful position as consumers are actively considering buying decisions.

The DV report highlights several potential benefits of using RMNs for advertisers:

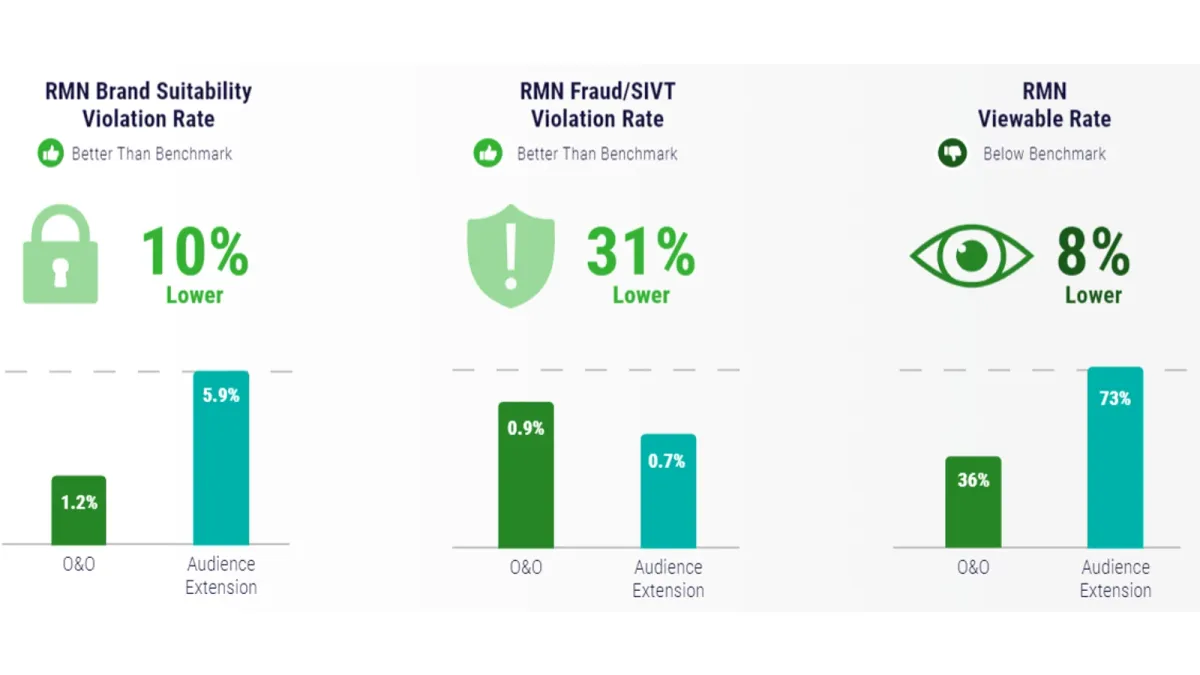

Strong Brand Suitability & Low Ad Fraud: RMNs outperform industry benchmarks for brand suitability and ad fraud. According to DV's research, brand suitability violations are 10% lower in RMNs compared to the overall benchmark, while ad fraud rates are nearly a third lower (31% lower). This suggests a lower risk of encountering inappropriate content or fraudulent activity within RMN ad placements.

High User Engagement: Despite lower than average viewability (impressions where users have a chance to see the ad), impressions served on a retailer's owned and operated properties (O&O inventory) demonstrate significantly higher engagement rates. DV reports a 183% increase in engagement compared to their baseline metric. This suggests that even if some O&O ads are not fully viewable, they may still be effective at capturing user attention at a crucial point in the buying journey.

Challenges of RMNs

The report also identifies a key challenge associated with RMNs:

Lower Viewability: Overall viewability rates for RMNs are 8% lower than the DV benchmark. This is particularly true for O&O inventory, where the average viewable rate sits at just 36%. Audience extension inventory, on the other hand, performs better with a viewable rate of 73%. This discrepancy may be due to the prioritization of user experience and conversion optimization on e-commerce platforms, where ad viewability may not be a primary focus.

DV's research suggests that RMNs offer a promising avenue for advertisers, particularly those seeking brand-safe environments and high user engagement. While viewability remains a challenge, especially for O&O inventory, the potential for targeted advertising at the point of purchase and the demonstrated user engagement may outweigh this drawback for some advertisers. As the retail media landscape continues to evolve, it will be interesting to see if solutions are developed to improve viewability rates within O&O inventory while maintaining a positive user experience.