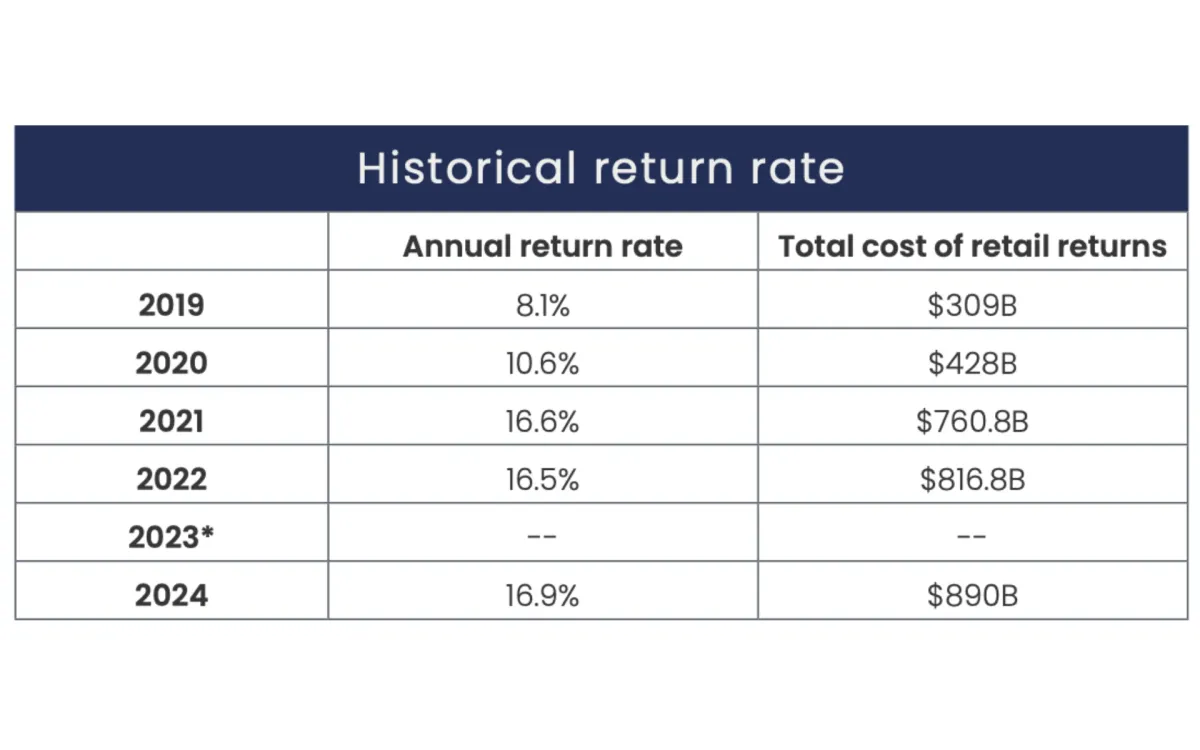

Two days ago, on December 5, 2024, the National Retail Federation (NRF) and Happy Returns released a comprehensive report showing that retail returns continue to pose substantial costs for the industry, with projected returns reaching $890 billion in 2024. The analysis reveals fundamental shifts in consumer behavior and retailer responses to growing operational challenges.

According to the report, retailers estimate 16.9% of their annual sales will be returned in 2024, maintaining elevated levels compared to pre-pandemic figures of 8.1% in 2019. Online channels face even greater challenges, with digital return rates averaging 21% higher than overall return rates.

The holiday season intensifies these challenges. According to Katherine Cullen, NRF Vice President of Industry and Consumer Insights, "Returns play an important role within the retail ecosystem and offer an additional touchpoint for retailers to provide a positive interaction with their customers."

The study, conducted in fall 2024, surveyed 2,007 consumers who had returned at least one online purchase within the past year and 249 ecommerce professionals from large U.S. retailers with revenue exceeding $500 million.

Consumer expectations significantly influence return policies. The data shows that 76% of consumers consider free returns a key factor when deciding where to shop, while 67% indicate a negative return experience would discourage future purchases from that retailer.

The practice of "bracketing" - purchasing multiple items with the intent to return some - has become increasingly prevalent among younger consumers. The research indicates that 51% of Gen Z consumers engage in this practice for apparel and footwear purchases, with 14% reporting they "always bracket." This contrasts sharply with lower rates among Gen X (36%) and Baby Boomers (24%).

Retailers face mounting pressure from fraudulent and abusive returns. According to the report, 93% of merchants identify retail fraud as a significant business issue. In response, 99% of retailers now employ various tactics to reduce return fraud, including requiring item verification before issuing refunds (56%) and modifying refund methods after designated timeframes (51%).

The financial impact has led 66% of retailers to start charging for one or more return methods in the past year. The primary reasons cited include increases in operational costs (44%) and rising carrier shipping costs (41%).

For the upcoming holiday season, retailers expect return rates to be 17% higher than their annual average. To manage this surge, 40% plan to seek additional support from third-party logistics providers, while 34% will hire seasonal staff specifically for handling returns.

Looking ahead to 2025, 68% of retailers are prioritizing upgrades to their returns capabilities within the next six months. David Sobie, co-founder and CEO of Happy Returns, notes, "Return policies are no longer just a post-purchase consideration – they're shaping how younger generations shop from the start."

The data shows that both consumers and retailers agree on the importance of convenient returns, but differ on implementation. While 71% of consumers prefer return options with instant refunds, only 27% of retailers view this as a top priority for their customers.

The environmental aspect of returns presents another divergence: 38% of retailers believe consumers will pay more for sustainable return options, yet fewer than 10% of shoppers list sustainability among their top three considerations when returning items.

Consumer preferences regarding return logistics reveal specific patterns: 64% prefer printerless returns, 63% favor buy-online-return-in-store options, and 62% choose no-box/no-label returns. Most consumers, particularly younger demographics, are unwilling to travel more than five miles to complete a return.

The NRF study provides comprehensive data showing how retail returns have evolved from a post-purchase consideration to a critical factor influencing initial purchase decisions, presenting both challenges and opportunities for retailers adapting to changing consumer expectations.