The Trade Desk reports accelerated growth with 27% revenue increase in Q3 2024

Digital advertising platform reports strong financial performance driven by CTV growth and retail media expansion.

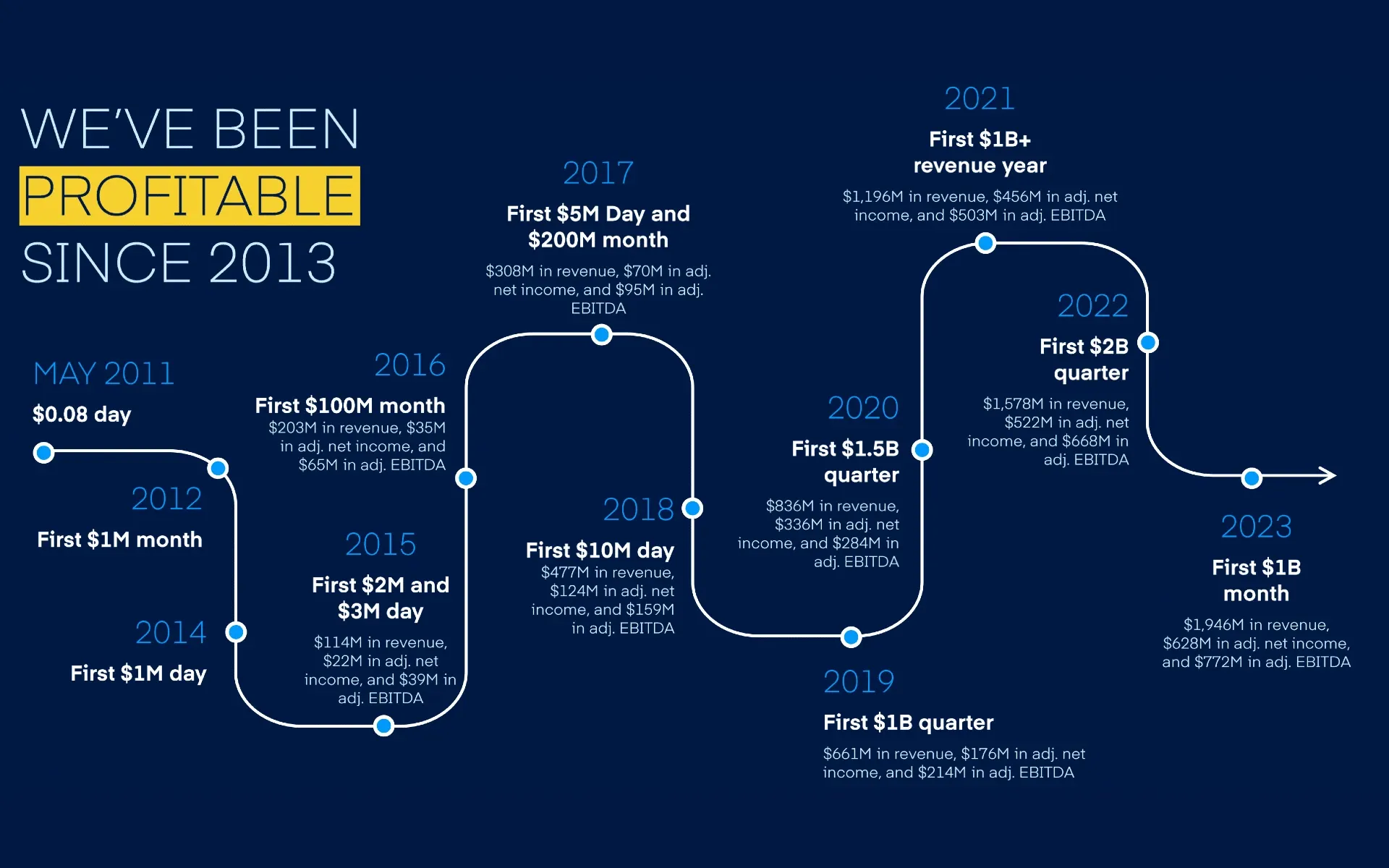

The Trade Desk (NASDAQ: TTD), a global technology platform for digital advertising buyers, reported revenue of $628 million for the third quarter of 2024, representing a 27% increase compared to the same period last year. The company's growth accelerated both sequentially and year-over-year, demonstrating continued market share gains in the digital advertising industry.

Net income for Q3 reached $94.2 million, or $0.19 per diluted share, up significantly from $39.4 million in Q3 2023. The company maintained strong profitability with an adjusted EBITDA of $257 million, representing a 41% margin.

Connected TV (CTV) emerged as the company's fastest-growing channel despite already being a significant portion of the business. According to company reports, video, including CTV, represented nearly 50% of the company's total spend during the quarter.

"2024 has been a banner year for CTV. Many of the largest media companies are now working with us to help clients capture the full value of CTV advertising via programmatic," said Jeff Green, Co-founder and CEO of The Trade Desk.

The company expanded key partnerships during the quarter, including:

- Spotify extending its partnership with The Trade Desk, piloting integrations with OpenPath and UID2

- Roku adopting UID2 for enhanced targeting capabilities

- Reach, a UK news publisher, implementing EUID across its 130 media brands

- Motorsport Network adopting EUID for its 60 million authenticated users

The Trade Desk maintained its strong market position with a customer retention rate exceeding 95% for the tenth consecutive year. The company's growth strategy focuses on several key areas:

- Expansion of Connected TV advertising capabilities

- Development of retail media partnerships

- Enhancement of measurement capabilities through retail data

- International market growth, with spend outside North America growing faster than domestic spending

- Implementation of AI-driven innovations through the Kokai platform upgrade

Looking ahead to Q4 2024, The Trade Desk provided guidance projecting revenue of at least $756 million, representing approximately 25% year-over-year growth. The company expects adjusted EBITDA of approximately $363 million for the fourth quarter.

"As we enter our busiest time of year and look ahead to 2025, we have never been in a better position to capture greater share of the $1 trillion advertising TAM," stated Green.

Google's market position shift creates new opportunities

A significant portion of The Trade Desk's competitive advantage stems from the evolving dynamics with Google, its largest competitor. According to CEO Jeff Green's analysis, Google faces multiple pressures that could benefit The Trade Desk:

"Google has an incredibly dominant, money-making business in Search and another in YouTube. They also have an incredible opportunity in Cloud and AI, most notably in Gemini," explained Green. "Because of the AI race in big tech and these opportunities, Google could continue to downgrade their network business to focus on those prospects."

Competitive differentiation through supply chain transparency

The Trade Desk is positioning itself as the transparent alternative to walled gardens. While some competitors focus on maximizing margins through less transparent practices, The Trade Desk emphasizes adding value over extraction. Green stated: "There are many in our industry who share the ethos to add value—and we're aiming to partner with nearly all of them. However, there are many that don't - Some who take a more short-term approach."

Market share gains against competition

The company's 27% revenue growth in Q3 2024 indicates significant market share gains against competitors. Key competitive advantages include:

- Buy-side focus and objectivity

- Strong partnerships with premium content providers

- Advanced identity solutions through UID2

- AI-driven platform improvements through Kokai

- Leadership in CTV advertising

Strategic partnerships strengthen competitive position

The Trade Desk is building strategic moats through partnerships with major media companies and publishers, making it harder for competitors to replicate their success. Notable competitive wins include:

- Extended partnership with Spotify for programmatic advertising

- Integration with Roku for enhanced targeting capabilities

- Collaboration with major retailers for retail media networks

- Partnerships with premium publishers through OpenPath

"I believe it is worth noting again we continue to significantly gain market share. I believe our level of relative outperformance, 27 percent revenue growth in the third quarter, is indicative of the value we are delivering to our clients as they deal with an uncertain consumer environment," stated Green.

The company's competitive position appears to be strengthening as the digital advertising landscape evolves, particularly with Google's antitrust challenges and the industry's increasing focus on transparency and value creation over extraction.

Key Facts

- Q3 2024 Revenue: $628 million (27% YoY growth)

- Net Income: $94.2 million

- Adjusted EBITDA: $257 million (41% margin)

- Customer Retention Rate: >95%

- Available Cash and Investments: $1.7 billion

- No Outstanding Debt