The Competition and Markets Authority (CMA) in the United Kingdom has taken a significant step in its ongoing investigation into Google's ad tech practices. On Friday, September 6, 2024, the CMA issued a statement of objections to Google, outlining provisional findings that the tech giant may have abused its dominant market position in open-display advertising technology.

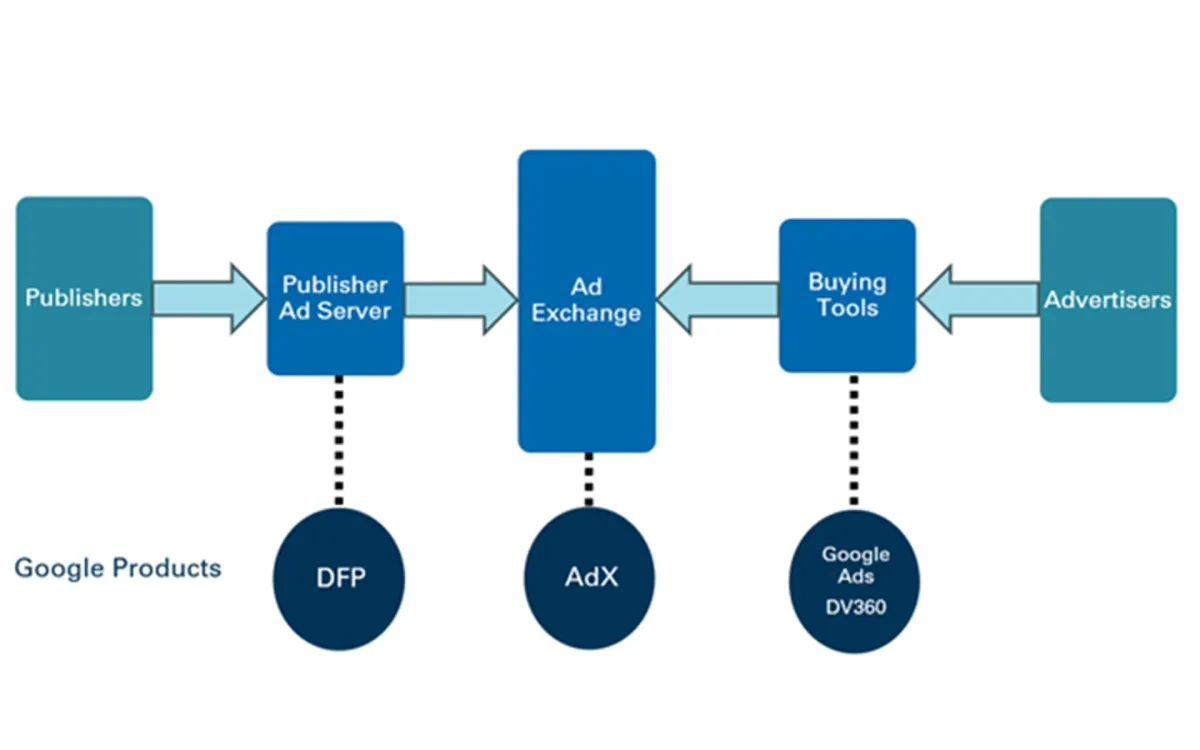

The CMA's investigation, which began on May 25, 2022, focuses on Google's role as an intermediary in three key parts of the ad tech chain:

- Ad buying tools for advertisers: "Google Ads" and "DV360"

- Publisher ad server: "DoubleClick For Publishers" (DFP)

- Ad exchange: "AdX"

According to the CMA, Google has potentially engaged in anti-competitive 'self-preferencing' practices since at least 2015. These practices allegedly strengthen AdX's market position and protect it from competition from other exchanges. The CMA provisionally finds that Google's conduct has also prevented rival publisher ad servers from effectively competing with DFP, harming competition in this market.

Juliette Enser, Interim Executive Director of Enforcement at the CMA, stated: "We've provisionally found that Google is using its market power to hinder competition when it comes to the ads people see on websites."

Specific Anti-Competitive Practices

The CMA has identified several practices that allegedly give AdX competitive advantages and disadvantage Google's rivals:

- Providing AdX with exclusive or preferential access to advertisers using Google Ads' platform

- Manipulating advertiser bids to have higher value in AdX's auction compared to rival exchanges

- Allowing AdX to bid first in auctions run by DFP, effectively giving it a 'right of first refusal'

These practices, according to the CMA, are ongoing and potentially harm both advertisers and publishers in the UK digital advertising market.

Impact on UK Digital Advertising Market

The CMA's 2019 market study into digital advertising found that advertisers were spending approximately £1.8 billion annually on open-display ads in the UK. This significant spending highlights the importance of fair competition in the ad tech sector for both advertisers and publishers.

Enser emphasized the broader implications of these practices: "Many businesses are able to keep their digital content free or cheaper by using online advertising to generate revenue. Adverts on these websites and apps reach millions of people across the UK – assisting the buying and selling of goods and services."

The Ad Tech Stack and Google's Role

The digital advertising technology sector, commonly referred to as the 'ad tech stack', consists of various intermediaries facilitating the sale of online open-display advertising space. When a user opens a website or app, a near-instantaneous series of auctions and transactions takes place to determine which ads will be shown.

Google operates key components in this process:

- Publisher ad servers (e.g., DoubleClick For Publishers)

- Ad buying tools (e.g., Google Ads, DV360)

- Ad exchanges (e.g., AdX)

The CMA's investigation focuses on Google's powerful market position in these areas, with high market shares in each component.

Potential Consequences and Next Steps

If the CMA's final decision confirms these provisional findings, Google could face significant consequences. The CMA has the authority to impose financial penalties of up to 10% of a company's annual worldwide group turnover for infringements of competition law.

The CMA will now carefully consider representations from Google before reaching its final decision. The timeline for the investigation indicates that written and oral representations on the statement of objections will be received between December 2024 and March 2025, with consideration of these representations expected to take place from April 2025 to December 2025.

International Context

The CMA's action in the UK aligns with similar investigations by other regulatory bodies:

- The US Department of Justice has opened an investigation into Google's activities in ad tech.

- The European Commission is also conducting a separate investigation into similar concerns.

These parallel investigations highlight the global scrutiny of Google's ad tech practices and their potential impact on digital advertising markets worldwide.

Key Facts

- Investigation opened: May 25, 2022

- Statement of objections issued: September 6, 2024

- Estimated timeline for final decision: December 2025

- UK advertisers' annual spend on open-display ads (2019): £1.8 billion

- Maximum potential fine: Up to 10% of Google's annual worldwide group turnover

Technical Details of Google's Ad Tech Stack

- Publisher Ad Server (DoubleClick For Publishers - DFP):

- Manages advertising space on websites and apps

- Decides which ads to show based on various factors

- Ad Buying Tools (Google Ads and DV360):

- Used by advertisers and media agencies to purchase display ads

- Automate the process of bidding for ad space

- Ad Exchange (AdX):

- Facilitates real-time auctions between publishers and advertisers

- Matches available ad space with advertiser bids

- Charges the highest fees in Google's ad tech stack (approximately 20% of the bid amount)

Summary of Key Points

- The CMA has provisionally found that Google abused its dominant position in open-display ad tech.

- Google's practices allegedly harm competition and disadvantage UK advertisers and publishers.

- The investigation focuses on Google's role in three key parts of the ad tech chain: ad buying tools, publisher ad server, and ad exchange.

- Anti-competitive practices include preferential access, bid manipulation, and 'right of first refusal' in auctions.

- The UK digital advertising market is significant, with £1.8 billion spent annually on open-display ads.

- Similar investigations are ongoing in the US and EU.

- The CMA's final decision is expected by December 2025, with potential financial penalties of up to 10% of Google's annual worldwide group turnover.