Instacart Ads exceed expectations with a 7% YoY increase in ad revenue to $243 million

Today Instacart's Q4 2023 earnings call presented positive developments for Instacart Ads, exceeding expectations with a 7% YoY increase in ad revenue to $243 million.

Today Instacart's Q4 2023 earnings call presented positive developments for Instacart Ads, exceeding expectations with a 7% YoY increase in ad revenue to $243 million. Beyond financial figures, the platform is poised to redefine online grocery advertising through continued growth and strategic expansion.

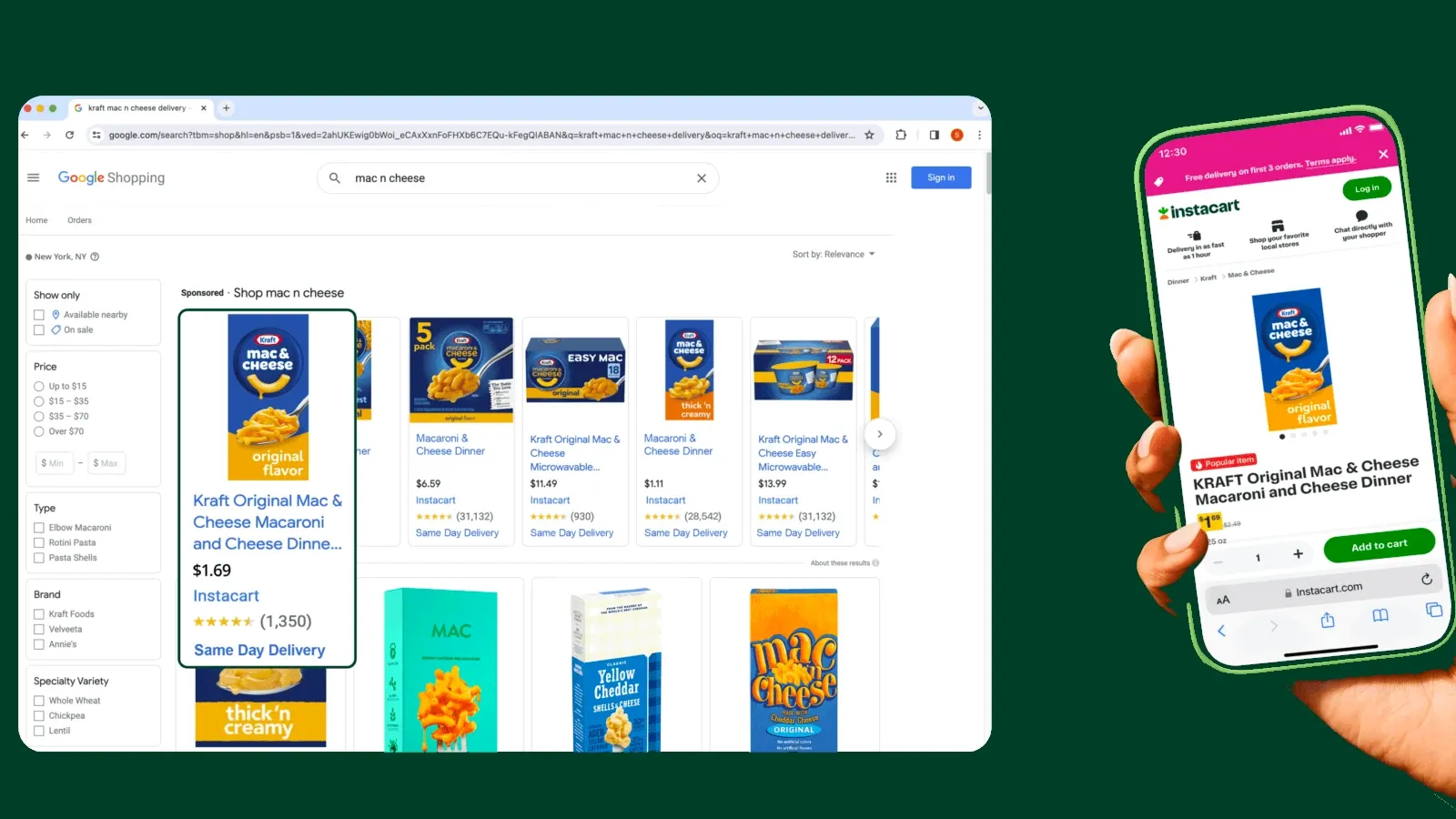

Unmatched Reach and Scale: As the largest online grocery marketplace with over 85,000 stores and 1,500 retail partners, Instacart reaches 95% of US households. This translates to a significant audience of high-intent shoppers actively seeking grocery and household essentials, offering a valuable opportunity for marketers.

Direct Impact on Purchasing Decisions: Unlike traditional display ads, Instacart Ads integrates seamlessly within the shopping experience, directly influencing purchase decisions. This results in a notable 15% sales lift for brands, highlighting its effectiveness in impacting shoppers at the point of purchase.

Precise Targeting: Instacart Ads leverages real-time data and AI to deliver targeted campaigns. It reaches niche audiences based on past purchases, shopping habits, and even in-store behavior through Caper Carts. This ensures messages resonate with the right shoppers, maximizing return on ad spend.

Omnichannel Expansion: Instacart is actively expanding into omnichannel solutions. Caper Carts bring targeted advertising directly into physical stores, influencing in-store purchases alongside online engagement. This strategic move broadens reach and impact for brands.

Future-Oriented Investment: Instacart prioritizes innovation. Partnerships with Google and The Trade Desk, alongside initiatives like Retail Media Network and Sell Sheets, solidify their advertising offerings and provide brands with exceptional access and insights.

Key Takeaways:

- GTV: Up 7% YoY to $7.89 billion, exceeding guidance.

- Orders: Up 5% YoY to 70.1 million.

- Revenue: Up 6% YoY to $803 million.

- Adjusted EBITDA: Up 50% YoY to $199 million.

- Profitable growth: First profitable quarter since IPO.

- Focus: Expanding selection, quality, speed, and advertising platform.

- Future: Investing in marketing, innovation, and omnichannel solutions.

Highlights:

- Selection: Largest online grocery marketplace with over 85,000 stores.

- Quality: Best-in-class order accuracy and high repeat purchase rates.

- Speed: Growing priority delivery options and batch rate efficiency.

- Advertising: Strong platform with high on-platform advertising & other revenue.

- Innovation: Launching Caper Carts for in-store shopping and personalization.

- Financial outlook: Q1 2024 GTV growth expected to accelerate to 7-10%.

Challenges:

- Mature cohort GTV decline: Offset by new customer acquisition.

- Competition: Facing pressure from other grocery delivery services.

- Stock-based compensation: Significant impact on GAAP net income.