On August 1, 2024, Snap announced its financial results for the second quarter ended June 30, 2024, revealing continued growth in both users and revenue despite challenges in the broader advertising market. The social media and camera company, known for its popular Snapchat app, reported significant milestones in user engagement and progress in its direct response advertising business.

According to the earnings release, Snap's revenue for Q2 2024 reached $1.24 billion, representing a 16% increase year-over-year. This growth came despite headwinds in brand advertising spend, particularly in certain consumer discretionary verticals such as retail, technology, and entertainment. The company's focus on direct response advertising and its subscription offering, Snapchat+, contributed to the overall revenue expansion.

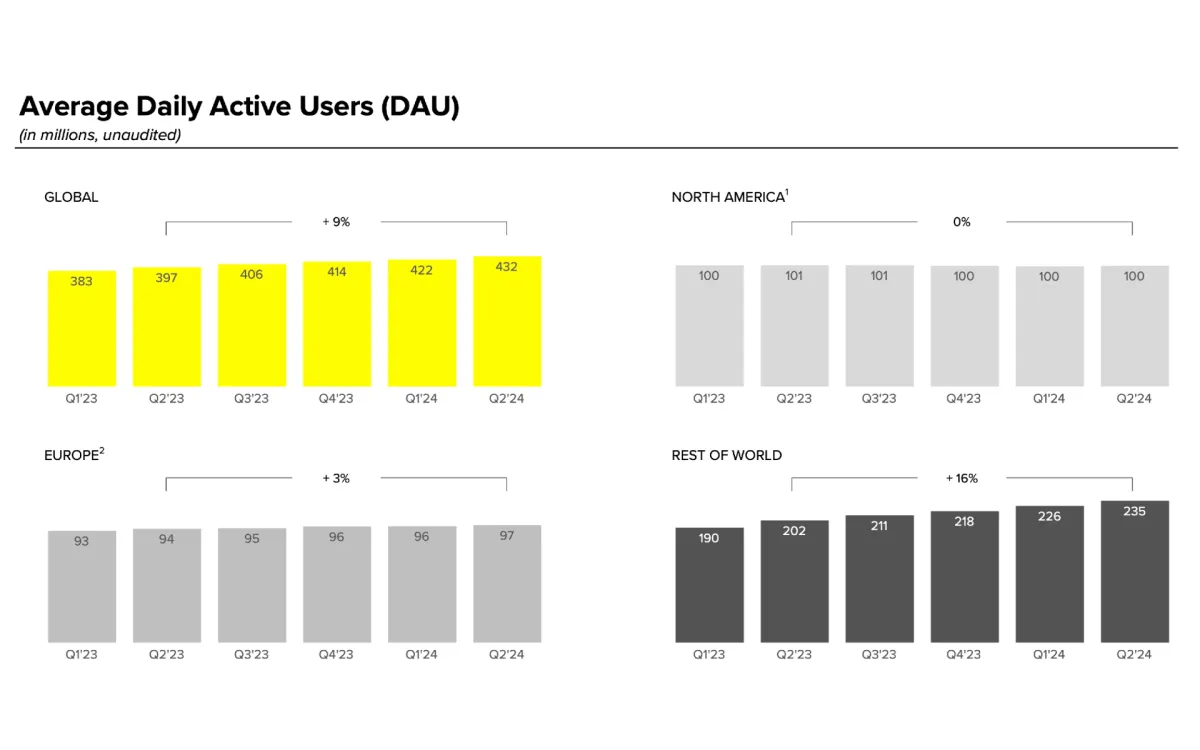

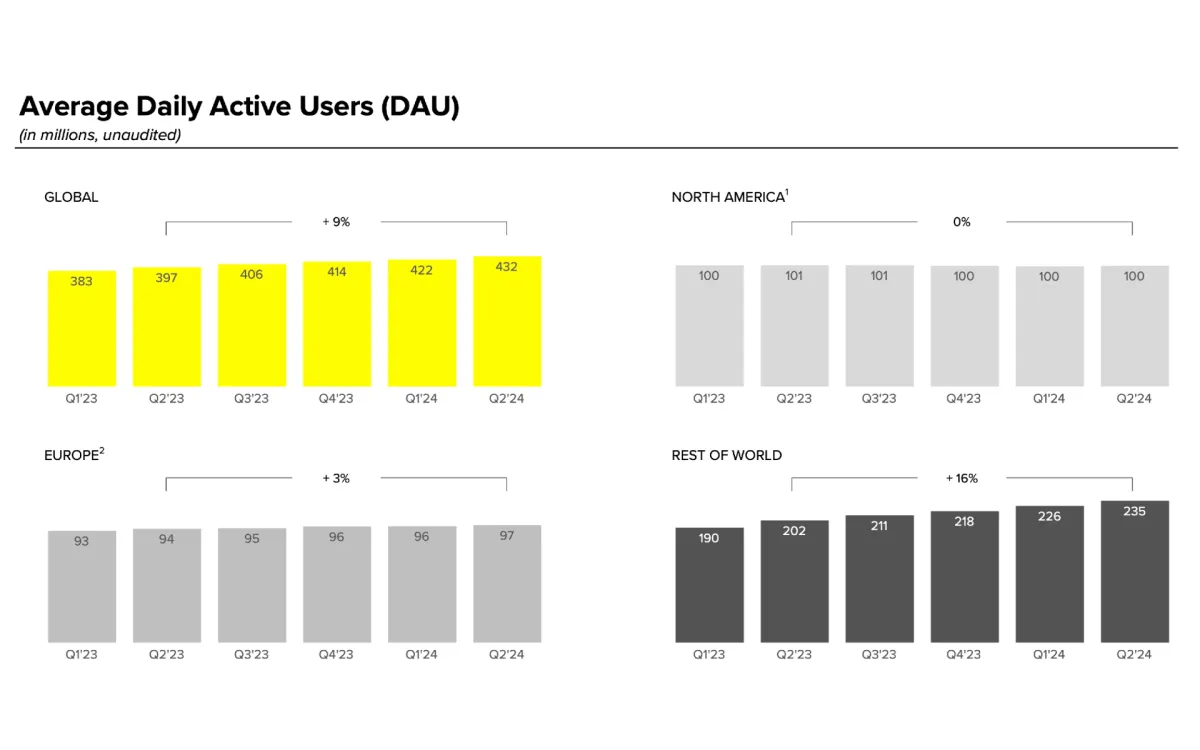

Snap's user base continued to expand, with daily active users (DAUs) growing to 432 million in Q2, an increase of 36 million or 9% compared to the same period last year. More notably, the company surpassed 850 million monthly active users (MAUs), marking a significant milestone in its quest to reach 1 billion MAU. This growth in the user base demonstrates Snap's ongoing appeal, especially among younger demographics.

The company's financial performance showed signs of improvement in profitability metrics. Net loss for the quarter was $249 million, a 34% reduction from the $377 million loss reported in Q2 2023. Adjusted EBITDA, a measure of operational profitability, turned positive at $55 million, compared to a loss of $38 million in the prior year period. This improvement reflects Snap's efforts to optimize its cost structure while investing in growth initiatives.

Evan Spiegel, CEO of Snap, emphasized the company's progress in scaling its advertising platform, noting that the number of active advertisers more than doubled year-over-year in Q2. This growth in the advertiser base, particularly among small and medium-sized businesses, is crucial for Snap's long-term revenue diversification strategy.

Snap's focus on augmented reality (AR) remains a key differentiator. The company reported that Snapchatters engage with AR Lenses billions of times per day on average. In Q2, the number of users sharing AR Lens experiences with friends increased by 12% year-over-year, driven by innovative generative AI Lenses and improved content ranking algorithms.

The company's subscription service, Snapchat+, reached a milestone of 11 million subscribers in Q2. This growing revenue stream contributes to Snap's efforts to diversify beyond advertising. Other non-advertising revenue, which includes Snapchat+ subscriptions, grew 151% year-over-year to reach $105 million in the quarter.

Despite the overall positive results, Snap faced challenges in certain areas. Brand-oriented advertising revenue declined 1% year-over-year, reflecting weakness in specific verticals and shifts in holiday timing. The company also noted mixed results in content engagement in North America, with time spent with content declining by just under 2% year-over-year while increasing nearly 6% quarter-over-quarter in Q2.

Looking ahead to Q3 2024, Snap provided guidance for revenue between $1.335 billion and $1.375 billion, implying year-over-year growth of 12% to 16%. The company expects its daily active user base to grow to approximately 441 million in Q3. Adjusted EBITDA for Q3 is projected to be between $70 million and $100 million.

Snap's Q2 results come amid a challenging macroeconomic environment and increased competition in the social media space. The company's ability to grow its user base and improve monetization, particularly through direct response advertising and subscriptions, has helped offset weakness in brand advertising spend.

The broader context for Snap's performance includes ongoing shifts in the digital advertising landscape, including privacy changes implemented by platforms like Apple that have impacted ad targeting capabilities. Snap has responded by investing in its first-party data solutions and machine learning capabilities to improve ad performance and measurement.

Snap's focus on augmented reality and camera-based experiences continues to set it apart from other social media platforms. The company's investments in AR technology, including the release of Lens Studio 5.0 with new generative AI capabilities, demonstrate its commitment to innovation in this space.

The growth in Snap's small and medium-sized business advertiser segment is particularly noteworthy, as it helps diversify the company's revenue sources and reduces reliance on large brand advertisers. This trend aligns with broader industry shifts towards performance-based advertising and self-serve ad platforms.

Snap's financial position remains solid, with $3.1 billion in cash and marketable securities on hand at the end of Q2. The company has been actively managing its debt, including issuing new convertible notes and repurchasing existing ones to strengthen its balance sheet.

As Snap moves into the second half of 2024, the company faces both opportunities and challenges. Its growing user base and improvements in ad technology provide a foundation for continued revenue growth. However, macroeconomic uncertainties and competition in the digital advertising market may present headwinds.

Investors and industry observers will be watching closely to see if Snap can maintain its user growth trajectory and continue to improve its monetization efforts. The company's upcoming Snap Partner Summit on September 17, 2024, is expected to showcase new product innovations and partnerships that could drive future growth.

In summary, Snap's Q2 2024 results demonstrate

Revenue growth of 16% year-over-year to $1.24 billion

Daily active users increased 9% year-over-year to 432 million

Monthly active users surpassed 850 million

Net loss improved 34% year-over-year to $249 million

Adjusted EBITDA turned positive at $55 million

Snapchat+ reached 11 million subscribers

Active advertisers more than doubled year-over-year

Q3 2024 revenue guidance of $1.335 billion to $1.375 billion