Nielsen, the global leader in audience measurement, data, and analytics, this week released its June 2024 report of The Gauge™, revealing a significant milestone in the television industry.

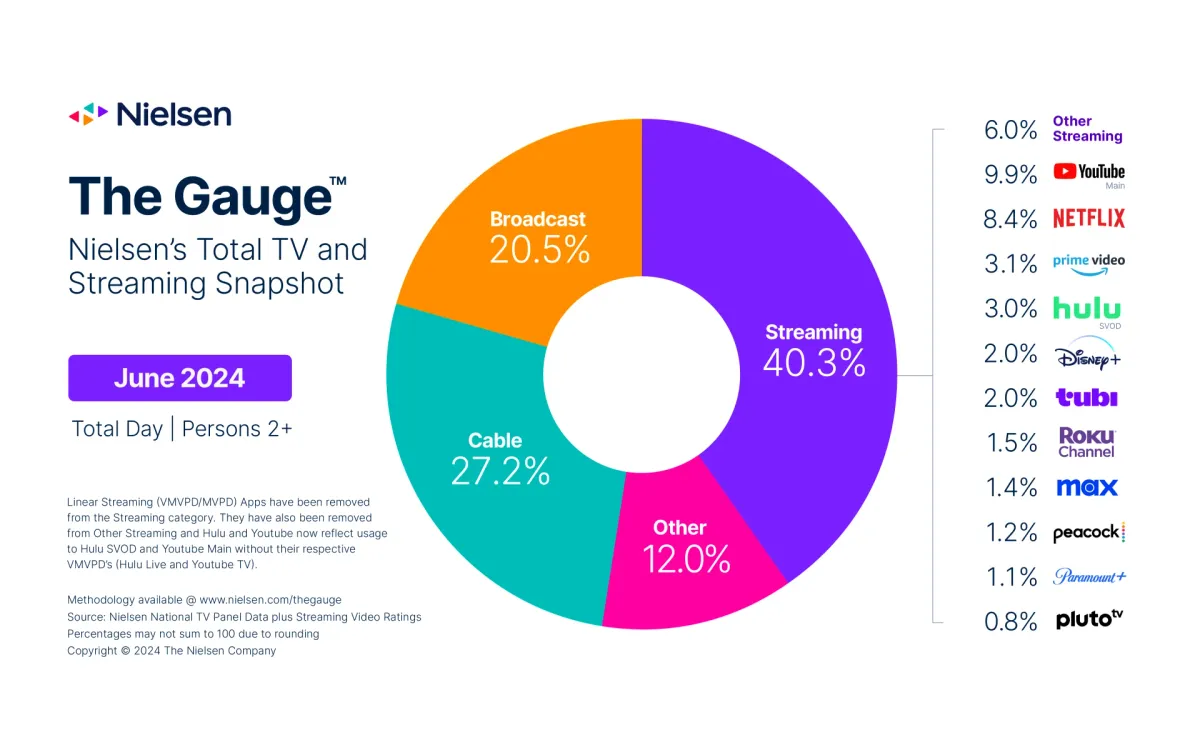

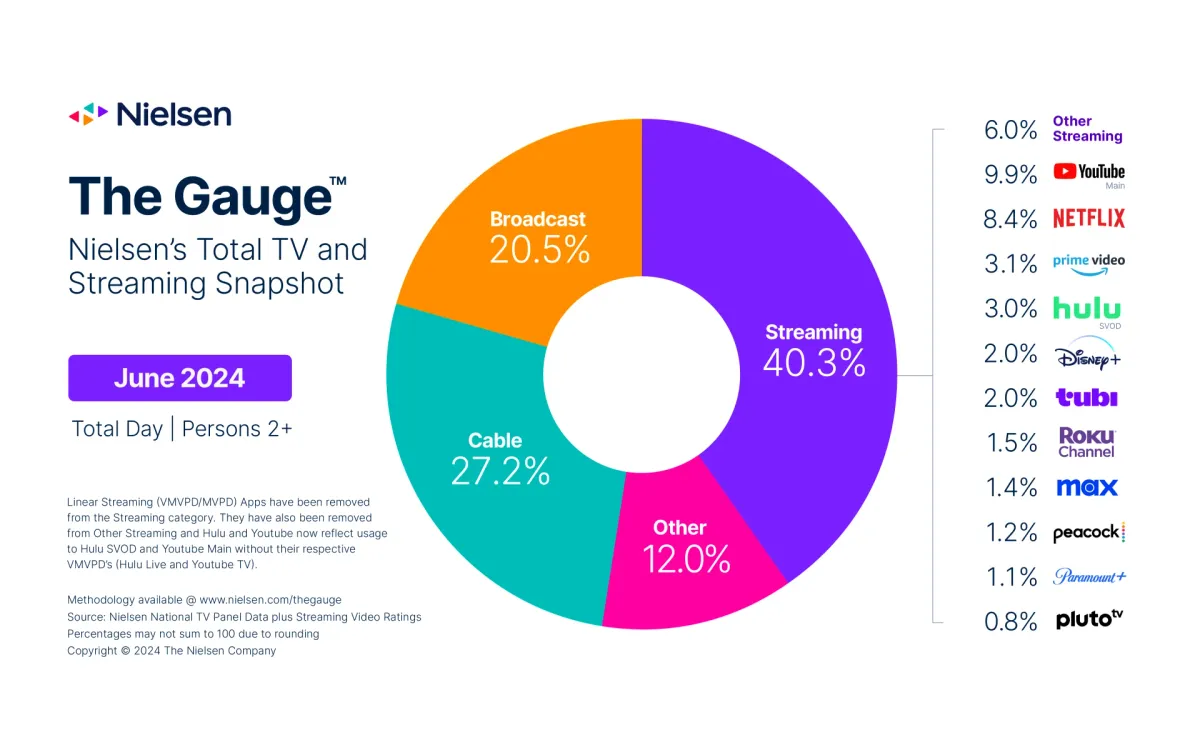

According to the report, streaming services captured an unprecedented 40.3% share of total TV usage in June, marking the highest share ever recorded for a single category in The Gauge's history. This groundbreaking statistic, announced just one day before today's date, surpasses the previous record of 40.1% set by cable in June 2021, signaling a major shift in viewer preferences and consumption patterns.

The Gauge, Nielsen's monthly snapshot of total broadcast, cable, and streaming consumption through television screens, provides a comprehensive look at audience viewing habits. This latest report underscores the rapidly evolving media landscape, where streaming platforms are increasingly dominating the attention of viewers across all age groups.

Several factors contributed to this record-breaking achievement for streaming services. The onset of summer break for most children and teenagers played a significant role, as viewers aged 17 and younger exhibited the largest increases in TV usage across all age demographics. This surge in free time led to a 6% increase in streaming viewership compared to May, with the category gaining 1.5 share points to reach the 40.3% mark.

Notably, four major streaming platforms experienced double-digit usage growth in June. Disney+ led the pack with a 14.8% increase, followed closely by Tubi at 14.7%, Netflix at 11.8%, and Max at 11.0%. These impressive growth figures were largely attributed to younger viewers, who accounted for 20% or more of the increased usage for each platform.

The streaming landscape saw several platforms approach or match their previous best performances. YouTube and Tubi, in particular, set new records with 9.9% and 2.0% of TV usage, respectively. Netflix came close to its all-time high, capturing 8.4% of total TV time, just shy of its record 8.5% set in July 2023.

Content played a crucial role in driving these numbers. Netflix's original series "Bridgerton" led all streaming titles with 9.3 billion viewing minutes, while "Your Honor," available on both Netflix and Paramount+, secured the second spot with 7.5 billion minutes. Other notable performances included Prime Video's "The Boys," which garnered 4 billion viewing minutes, and HBO's "House of the Dragon" on Max, which accumulated 3.4 billion minutes.

While streaming services celebrated their record-breaking month, traditional linear TV experienced a typical summer lull. Broadcast television claimed 20.5% of total TV time in June, benefiting from a 26% increase in sports viewership and a 5% rise in news consumption. The NBA Finals, aired on ABC, dominated the top five most-watched broadcast telecasts, followed by ABC's simulcast of CNN's Presidential Debate and Game 7 of the NHL Stanley Cup Finals.

Cable television, which accounted for 27.2% of TV usage in June, saw significant viewership for the CNN Presidential Debate. The simulcast debate claimed the top two cable telecasts of the month, with CNN leading with over 10 million viewers, followed by Fox News Channel with 9.5 million. Despite these high-profile events, cable's share of TV usage declined by 1.0 point from the previous month.

The rise of streaming and the corresponding decline in traditional linear TV viewership reflect broader trends in the media industry. As more consumers opt for on-demand content and personalized viewing experiences, streaming platforms are investing heavily in original programming and expanding their content libraries to attract and retain subscribers.

This shift has significant implications for advertisers and marketers. With audiences increasingly fragmented across multiple streaming services, traditional advertising models are being challenged. Advertisers are now exploring new ways to reach their target demographics, including product placement within streaming content, sponsorship of original series, and partnerships with streaming platforms for targeted ad delivery.

The advertising landscape in the streaming era is evolving rapidly. Many streaming services are introducing ad-supported tiers to attract price-sensitive consumers and create new revenue streams. This trend opens up new opportunities for advertisers to reach engaged audiences in a less cluttered environment compared to traditional TV advertising.

Moreover, the rise of streaming is driving innovation in ad tech. Programmatic advertising, which allows for more precise targeting and real-time bidding, is becoming increasingly sophisticated in the streaming space. This technology enables advertisers to deliver more relevant ads to viewers based on their viewing habits, demographics, and other data points, potentially increasing the effectiveness of their campaigns.

The impact of streaming's dominance extends beyond just viewership and advertising. It is reshaping the entire entertainment industry, influencing how content is produced, distributed, and consumed. Major media companies are restructuring their operations to prioritize streaming, with many launching their own direct-to-consumer platforms to compete in this rapidly growing market.

This shift has led to a content arms race, with streaming services investing billions of dollars in original programming to differentiate themselves and attract subscribers. The result is a golden age of television content, with viewers having access to an unprecedented variety of high-quality shows and movies across multiple platforms.

However, the proliferation of streaming services also presents challenges for consumers. As content becomes increasingly fragmented across different platforms, viewers may find themselves subscribing to multiple services to access all the content they want to watch. This fragmentation could potentially lead to subscriber fatigue and increased costs for consumers, which may drive demand for bundled streaming offerings or aggregation services in the future.

The rise of streaming is also having a profound impact on the traditional television industry. As viewers, especially younger demographics, spend more time on streaming platforms, traditional broadcasters and cable networks are forced to adapt their strategies. Many are launching their own streaming services or partnering with existing platforms to ensure their content reaches audiences where they are spending their time.

Looking ahead, the television industry is likely to continue evolving rapidly. The upcoming Summer Olympics, traditionally a major draw for broadcast and cable networks, will be a significant test of how major live events perform in this new streaming-dominated landscape. While linear TV typically experiences a viewership lull during the summer months, the Olympics could provide a temporary boost to traditional platforms.

As streaming continues to grow, questions about market saturation and sustainability arise. How many streaming services can the market support? Will there be consolidation in the industry as smaller players struggle to compete with giants like Netflix and Disney+? These are critical questions that industry analysts and investors will be closely monitoring in the coming years.

The impact of streaming's dominance extends beyond just the media industry. It has implications for internet infrastructure, as increased streaming puts greater demands on broadband networks. This could drive investment in network upgrades and potentially influence debates around net neutrality and internet regulation.

In conclusion, Nielsen's June 2024 report of The Gauge marks a significant milestone in the evolution of television consumption. The record-breaking 40.3% share captured by streaming services signifies a fundamental shift in how audiences consume content. As the industry continues to adapt to this new reality, we can expect further innovations in content creation, distribution, and advertising.

The dominance of streaming is reshaping not just how we watch television, but the entire media and entertainment landscape. It presents both challenges and opportunities for content creators, advertisers, and consumers alike. As we move forward, the ability to adapt to this rapidly changing environment will be crucial for success in the television industry.

While the future remains uncertain, one thing is clear: streaming has firmly established itself as a dominant force in the television ecosystem. How this will continue to evolve and what it means for the future of entertainment are questions that will undoubtedly be at the forefront of industry discussions for years to come.