Salesforce unveils AI-Powered tools to help banks resolve transaction disputes faster

These capabilities, built on the Einstein 1 Platform, integrate with Salesforce Financial Services Cloud to leverage customer data and automate manual tasks, aiming to improve efficiency and customer satisfaction.

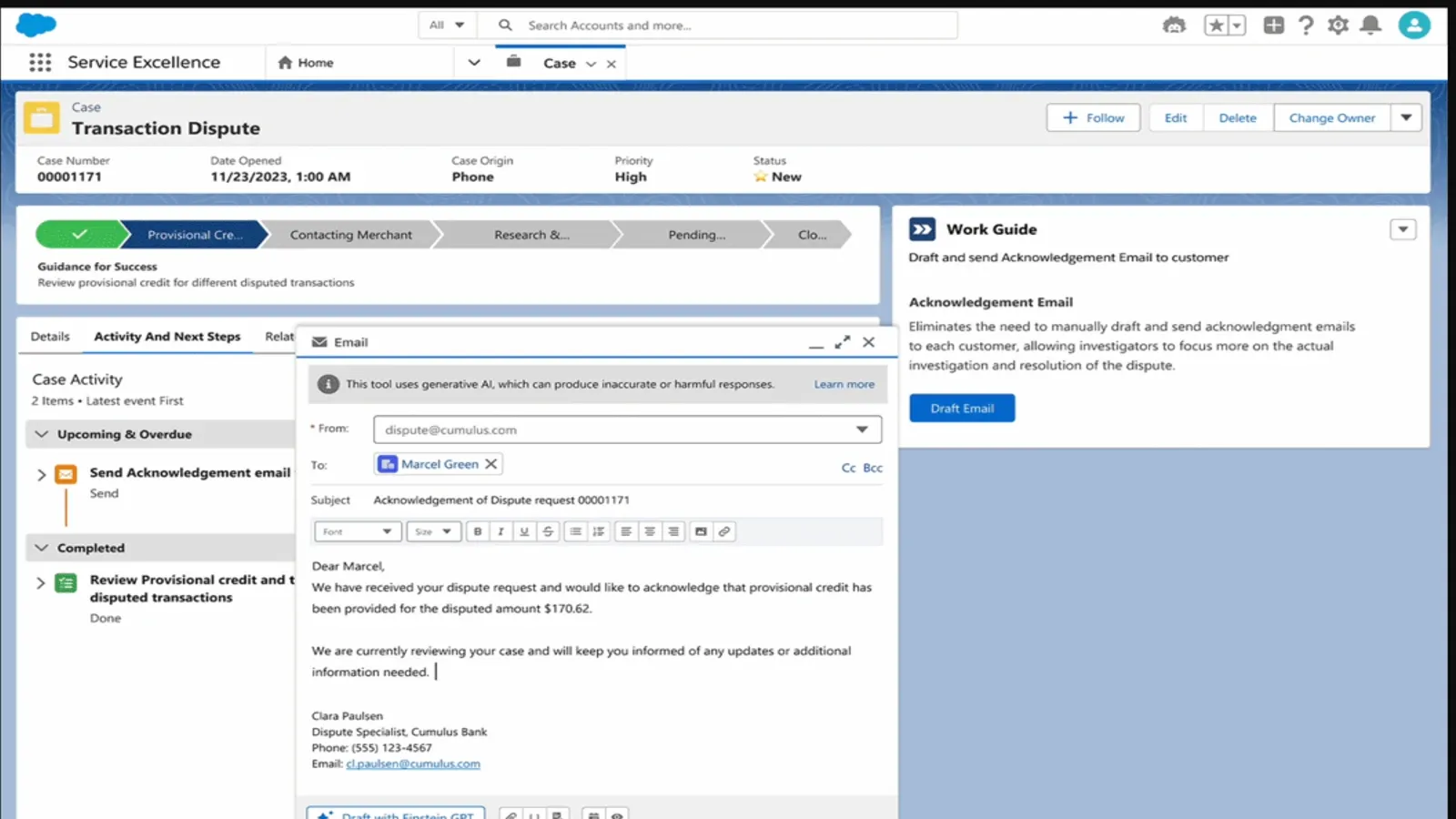

Salesforce this week announced a suite of new AI-powered features designed to streamline transaction dispute resolution for banks. These capabilities, built on the Einstein 1 Platform, integrate with Salesforce Financial Services Cloud to leverage customer data and automate manual tasks, aiming to improve efficiency and customer satisfaction.

The announcement comes amidst a significant rise in digital payments and online shopping, leading to an increase in customer chargebacks. According to sources cited by Salesforce, Americans disputed a staggering $83 billion in charges in 2023, highlighting the growing pressure on banks to manage these disputes effectively. Traditional dispute resolution processes are often complex and time-consuming, leading to frustration for both customers and bank agents.

Salesforce's new features target these pain points by offering:

- AI-Powered Transaction Dispute Management: This solution streamlines the entire dispute lifecycle, from initial submission to resolution. Bank agents can leverage pre-built email templates and generative AI to draft personalized communications with customers regarding dispute acknowledgments and outcomes. Additionally, integrations with card networks aim to simplify coordination with merchants involved in disputes.

- Einstein Copilot Banking Actions: This AI assistant empowers bank service agents to ask questions and receive relevant, data-driven responses within the Salesforce workflow. Agents can automate tasks like initiating fee reversals, issuing provisional credits, or retrieving customer transaction history, all without switching between applications. Importantly, these actions adhere to data governance standards thanks to the Einstein Trust Layer, ensuring security and privacy.

- Service Processes Library: Financial Services Cloud now includes a library of pre-built service process templates for common banking tasks, including transaction disputes, fee reversals, and card replacements. These templates aim to further expedite dispute resolution by providing agents with standardized workflows.

The importance of data

Salesforce emphasizes the role of high-quality data in powering these AI features. Data Cloud allows banks to unify transaction records from various sources, providing a comprehensive view for accurate responses. Additionally, the Vector Database facilitates the ingestion and management of unstructured data like policy documents, potentially leading to richer generative AI outputs. Bank agents benefit from a centralized view of relevant transaction data, enabling them to resolve disputes faster.

Customer and Industry Perspectives

Salesforce highlights the positive impact these tools can have on customer experience. Eran Agrios, SVP & GM for Financial Services at Salesforce, emphasizes how these capabilities simplify the entire dispute resolution process, allowing banks to deliver exceptional customer service and drive innovation.

Customer testimonials from PenFed Credit Union and BayPort Credit Union illustrate the potential benefits. PenFed highlights how AI and data provide a single view of member data, enabling personalized support. BayPort Credit Union expresses excitement about Data Cloud's potential for tracking member attrition.

Availability and Pricing

- AI-Powered Transaction Dispute Management: Generally available now.

- Services Processes Library: Generally available with 19 processes, including Transaction Dispute Management.

- Einstein Copilot Banking Actions: General availability planned for Fall 2024.

- Data Cloud: Generally available now.

- Vector Database: General availability expected in Summer 2024.