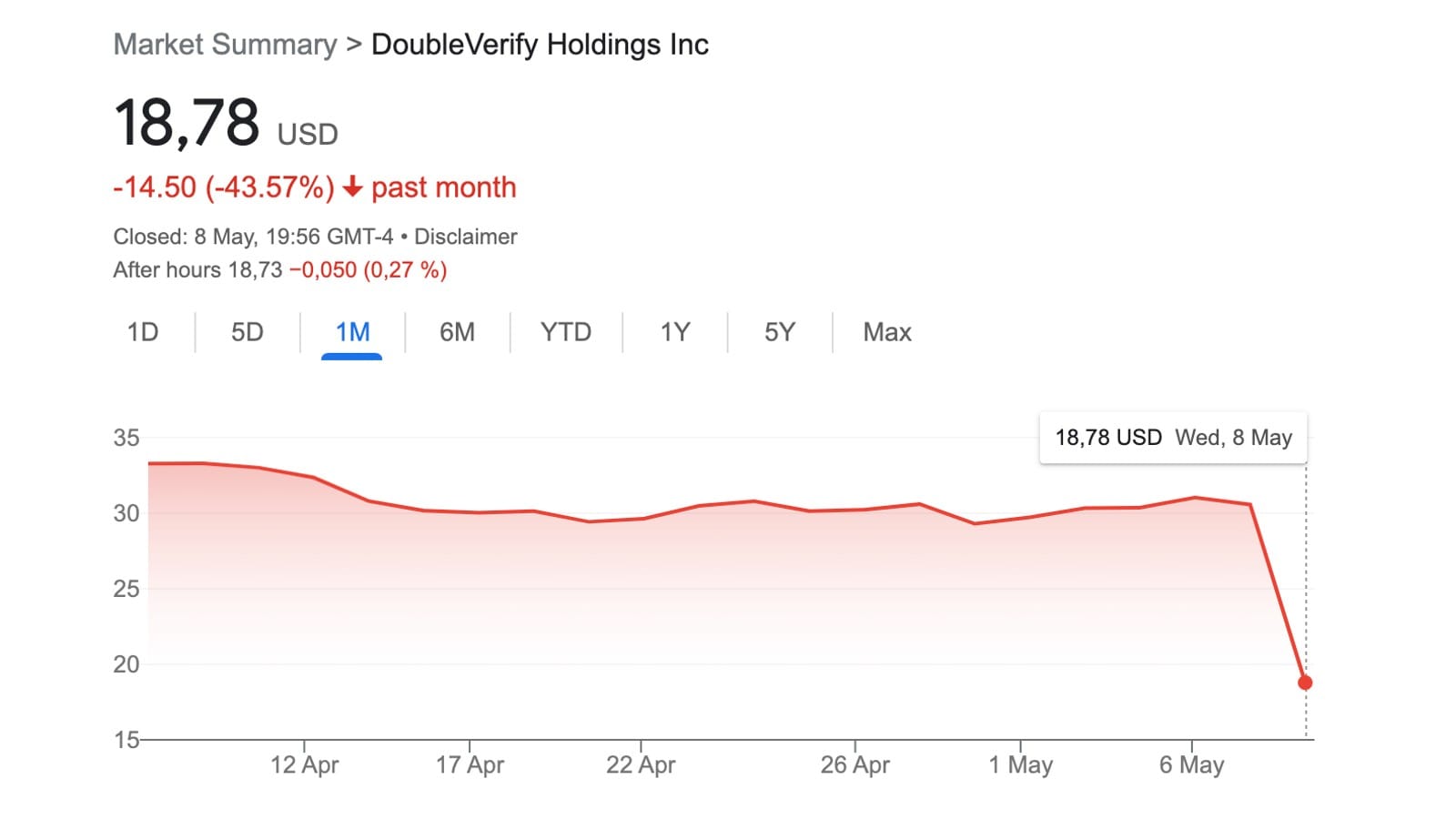

DoubleVerify stock tumbles after lowering Revenue Guidance

Shares of DoubleVerify (DV) plunged nearly 39% on Wednesday after the advertising technology company reported mixed first-quarter results and lowered its full-year revenue guidance.

Shares of DoubleVerify (DV) plunged nearly 39% yesterday after the advertising technology company reported mixed first-quarter results and lowered its full-year revenue guidance.

The company beat analyst expectations for the first quarter, generating nearly $141 million in revenue against a projected $140 million. It also achieved profitability with $7 million in net income.

However, investors reacted negatively to DoubleVerify's revised outlook for the rest of 2024. Management initially anticipated revenue growth of around 22% but now expects closer to 17%. This significant reduction in guidance raised concerns about the company's future performance.

Analysts were left puzzled by the disconnect between the strong Q1 results and the tempered outlook. Management explained that some customers, particularly those who pulled back on spending in April, were primarily responsible for the downward revision. This spending slowdown, especially after a positive first quarter, spooked investors who fear it might continue.

Further complicating the situation, DoubleVerify recently issued an apology for displaying inaccurate advertising data on social media platform X (formerly Twitter) for nearly five months. The company is investigating the error to prevent future occurrences. While the timing of the spending pullback and the data error raise questions, it's unclear if they are directly linked.

Despite the stock's sharp decline, DoubleVerify still projects double-digit revenue growth for the year, suggesting a healthy underlying business. Some investors might see this as an opportunity to buy the stock at a discount, considering its long-term potential. However, much depends on the company's ability to address the spending slowdown and rebuild customer confidence after the data inaccuracy issue.

DoubleVerify reports First Quarter 2024 Financial Results: Increased revenue by 15% Year-over-Year

Revenue Growth: DoubleVerify's total revenue increased by 15% year-over-year to $140.8 million in the first quarter of 2024. This growth was driven by strong performance in social and CTV (connected TV) measurement.

Profitability: The company achieved net income of $7.2 million and adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) of $38.1 million, representing a 27% adjusted EBITDA margin.

Product Success: DV's core verification and performance solutions saw continued success across social media and CTV platforms. The company also highlighted its progress in Scibids AI, a product that uses artificial intelligence for measurement.

International Expansion: Measurement revenue grew by 40% year-over-year, with significant growth in EMEA (Europe, Middle East, and Africa) and APAC (Asia-Pacific) regions.

New Business Wins: The press release mentions notable new enterprise customer wins like McAfee, Carlsberg, and Perigo.

Brand Safety and Suitability: DV expanded its brand safety and suitability measurement offerings on Facebook, Instagram, TikTok, and Amazon.

Attention Measurement: The company partnered with Netflix to measure attention at the impression level with DV's Authentic Attention® for CTV.

Impact on the Market

While the financial results are positive, the press release also mentions that DoubleVerify is adjusting its full-year 2024 guidance ranges to 17% revenue growth and 31% adjusted EBITDA margins at the midpoints. This adjustment is primarily due to uneven spending patterns among select large advertisers. Investors might react negatively to this news, but the press release assures them that the company is still on track for a successful year.