JCDecaux reports strong Q3 growth driven by digital advertising and olympics impact

JCDecaux posts 10.9% revenue growth in Q3 2024, reaching €948.2M, boosted by digital advertising and Paris Olympics impact.

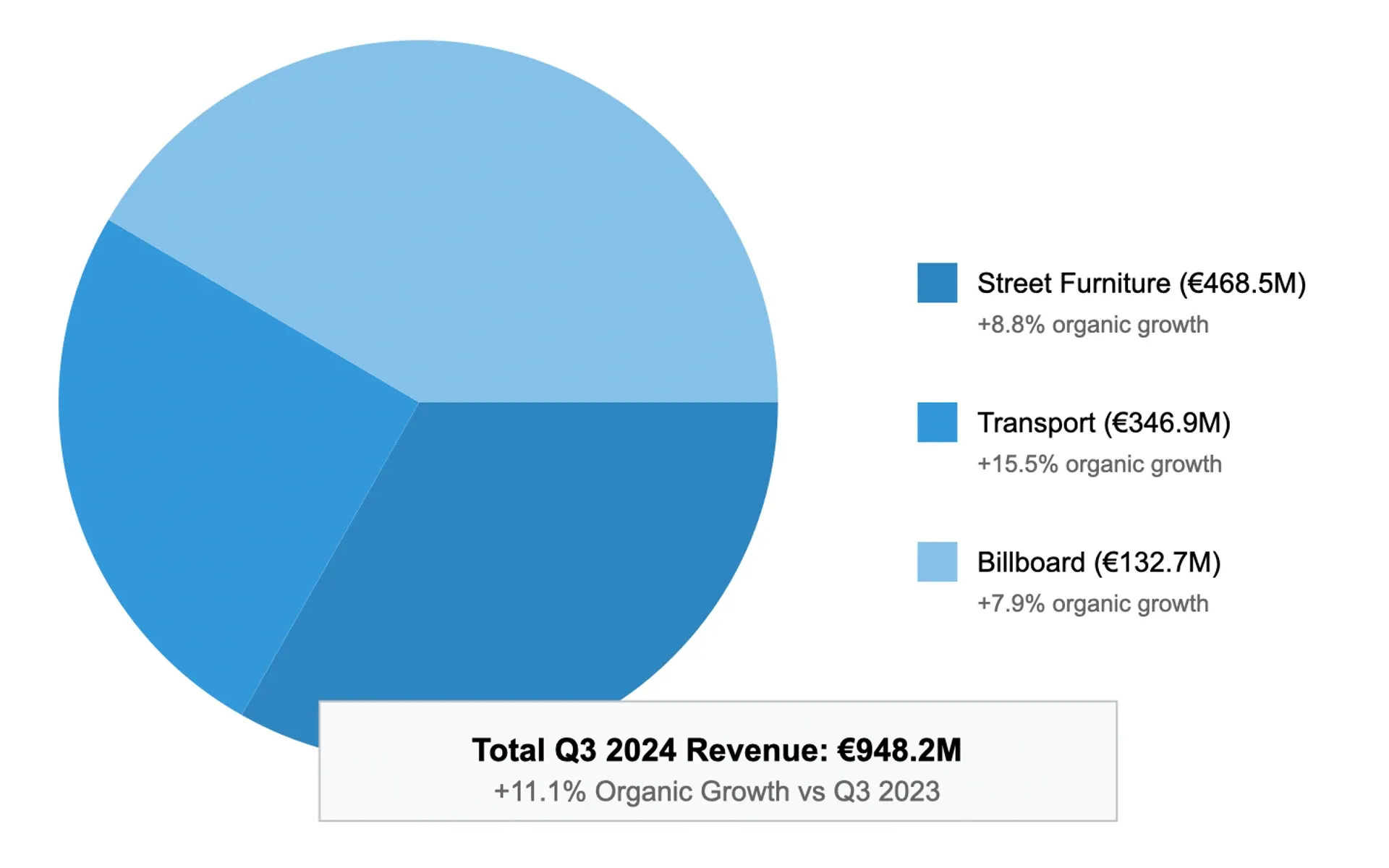

JCDecaux SE, the world's largest outdoor advertising company, announced its third quarter 2024 results on November 7, showing significant growth across all business segments. According to the company's financial report, total adjusted revenue increased by 10.9% to reach €948.2 million, compared to €855.0 million in the same period of 2023.

The performance exceeded expectations, with organic growth reaching 11.1% when excluding the impact of foreign exchange variations and perimeter changes. The strong results were primarily driven by digital revenue growth and the positive impact of the Paris Olympic and Paralympic Games in France.

Digital Out Of Home (DOOH) advertising emerged as a particular highlight, growing by 17.8% (18.5% on an organic basis) to achieve a new record high of 38.5% of total group revenue. This growth included strong performance in programmatic advertising revenue.

The company's Street Furniture division, which includes bus shelters and other urban advertising installations, recorded an 8.4% increase to €468.5 million. The Transport segment showed even stronger growth, rising 14.8% to €346.9 million, while Billboard revenue grew by 9.8% to €132.7 million.

France and the United Kingdom emerged as standout markets, delivering strong double-digit organic revenue growth. Other geographic regions maintained high single-digit growth rates. The Chinese market, while still operating below pre-COVID levels, achieved double-digit growth with increased digital penetration.

The Paris Olympic and Paralympic Games provided a significant boost to the French market, particularly benefiting the Street Furniture segment. This impact contributed to the overall strong performance in the domestic market.

JCDecaux's growth strategy in Q3 2024 was marked by several significant contract wins across key markets. In July, the company renewed its exclusive advertising contract with Macau International Airport for a 10-year period through its joint venture JCDecaux Macau.

A major victory came in September when Transport for London awarded JCDecaux the London bus shelter advertising contract for an 8-year period, with a possible 2-year extension. This contract, the second-largest bus shelter advertising agreement globally, covers more than 4,700 advertising bus shelters across all 33 London boroughs.

The company further strengthened its European presence by securing both the Stockholm bus shelter and central subway stations advertising contracts. These 7-year agreements with the Greater Stockholm Public Transport Authority will commence on January 1st, 2026, covering over 1,500 bus shelters and 14 major subway stations.

In July 2024, JCDecaux achieved a significant milestone when its carbon reduction trajectory received approval from the Science Based Targets initiative (SBTi). This validation represents the highest designation available through the SBTi process.

JCDecaux's Q3 2024 results reflect the continuing evolution of the outdoor advertising industry. The company's strong performance in digital advertising aligns with broader industry trends toward digitalization and programmatic advertising.

Digital Transformation

The company's digital revenue growth demonstrates the successful execution of its digital transformation strategy. With digital advertising now representing 38.5% of total revenue, JCDecaux has established itself as the most digitized global Out of Home Media company.

Market Share Growth

The company's performance indicates continued market share growth in an increasingly fragmented media landscape. Digital Out of Home advertising has emerged as the fastest-growing media segment, positioning JCDecaux to capitalize on this trend.

Looking ahead to Q4 2024, JCDecaux expects a more moderate growth rate in the low single digits. This projection takes into account several factors, including ongoing debates about government budgets in France and the UK, and expected flat performance in China due to low consumer demand.

The company's Q3 performance sets a strong foundation for future growth, though management acknowledges some macroeconomic uncertainties. The continued development of digital revenue is expected to remain a key driver of growth.

Key Facts

- Q3 2024 revenue: €948.2 million

- Organic growth: 11.1%

- Digital revenue share: 38.5%

- Street Furniture revenue: €468.5 million

- Transport segment revenue: €346.9 million

- Billboard revenue: €132.7 million

- London bus shelter contract: 4,700+ advertising shelters

- Stockholm contract: 1,500+ bus shelters

- Contract duration: 8 years (London), 7 years (Stockholm)

- Digital screens in London: 612 x 86" screens