Polish television consumption remained remarkably stable during August 2025, with viewers spending an average of 3 hours and 31 minutes daily watching TV screens, according to Nielsen's The Gauge report released in September 2025. This figure represents just a one-minute decrease from July's 3 hours and 32 minutes, demonstrating consistent viewing habits despite seasonal variations typically associated with summer months.

The data, published on September 2025, reveals significant patterns in how Polish audiences engage with television content across different platforms. Traditional television maintained its dominance while streaming services showed notable fluctuations following what Nielsen described as a "historic July" for digital viewing platforms.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Streaming share retreats from summer peak

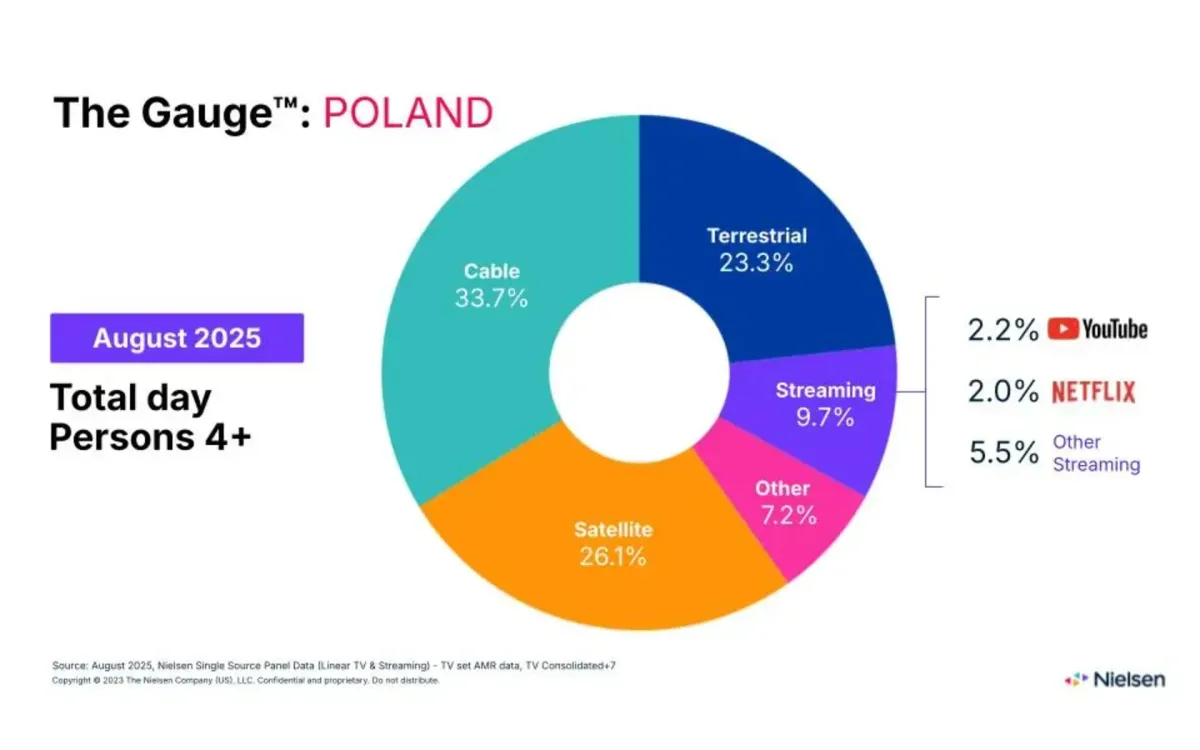

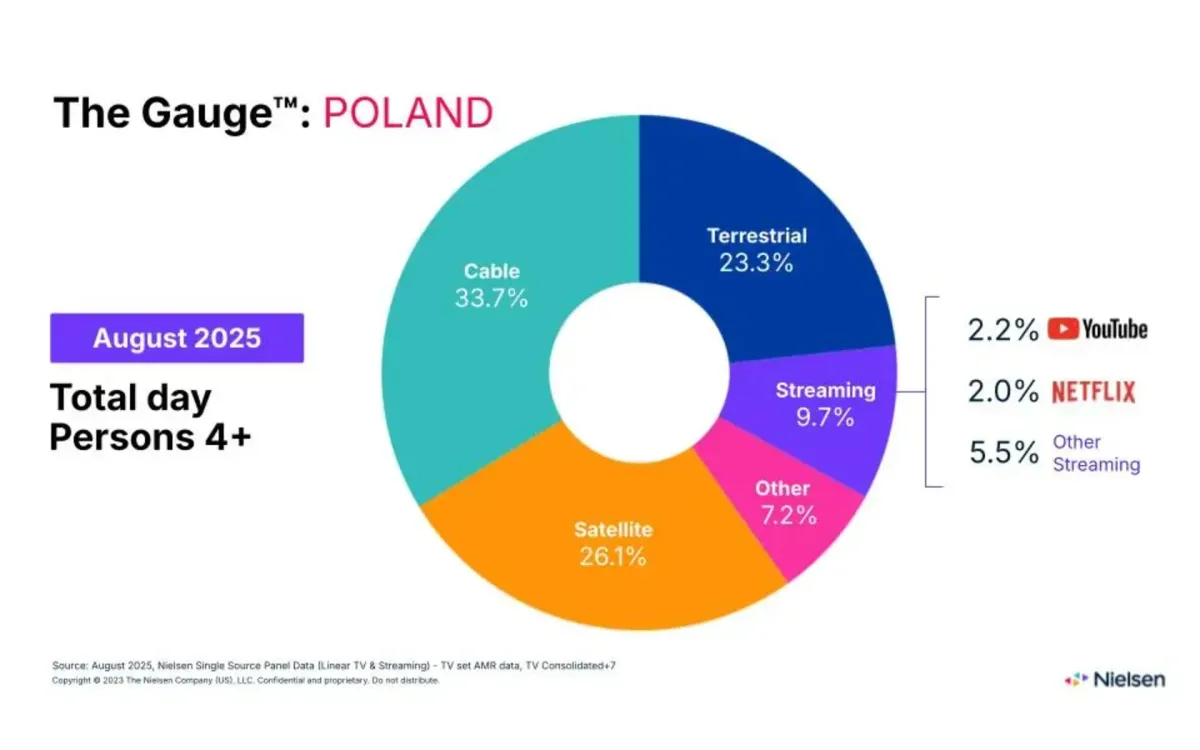

Streaming's portion of total television viewing time decreased to 9.7% in August 2025, down from an undisclosed peak in July that Nielsen characterized as historic. This retreat brings streaming viewership back to levels comparable with June 2025, suggesting seasonal variations affect digital platform consumption patterns.

YouTube maintained its leading position among streaming platforms, capturing 2.2% of total television viewing time, though this represents a decline from July's 2.4% share. The platform's consistent presence in Polish living rooms reflects its established role in the country's digital media landscape, where viewers regularly integrate YouTube content into their traditional television consumption habits.

Netflix demonstrated opposite momentum, increasing its share to 2.0% in August from 1.8% in July. This 0.2 percentage point gain positions the streaming giant as the second-largest platform in Poland's streaming ecosystem. The growth comes as Netflix commands 8.3% of total TV usage globally while streaming hits 46% market share, demonstrating varied performance across international markets.

Other streaming services collectively represented 5.5% of viewing time, indicating a diverse ecosystem beyond the dominant YouTube and Netflix platforms. This category includes services like Pilot WP, Canal+, and HBO Max, which according to the report "recorded the biggest increases for the month."

Political and sports events drive traditional viewing

The August 2025 television landscape featured "significant sports and political events that drew viewers to traditional channels," according to Nielsen's analysis. These programming elements contributed to traditional television's stability despite ongoing streaming growth trends observed in other international markets.

Polish audiences gravitated toward specific content types during this period. The most-watched programs included Fakty, described as TVN's flagship newscast, alongside volleyball matches broadcast on Polsat Sport and Polsat networks. Cultural programming also captured significant attention, with a concert celebrating the Warsaw Uprising anniversary on TVP1 drawing substantial viewership.

Political coverage proved particularly compelling for Polish viewers. President Nawrocki's inauguration coverage on TV Republika generated notable audience engagement, reflecting the continued importance of traditional broadcasters for major civic events. This pattern aligns with broader European trends where significant political moments drive audiences to established television networks.

Among traditional television stations, viewers most frequently selected TVP1, Republika, and Polsat. This preference distribution illustrates Poland's media landscape, where public broadcasting competes alongside commercial and political-oriented networks for audience attention.

Technical measurement methodology reveals viewing complexity

Nielsen Poland's measurement approach relies on sophisticated data collection systems designed to capture comprehensive viewing patterns across multiple platforms and devices. The company employs a single-source panel consisting of 3,500 households encompassing almost 9,700 individual panelists throughout Poland.

The Gauge methodology tracks viewing behavior across cable, satellite, and terrestrial television systems. This includes both linear programming and time-shifted viewing up to seven days after original broadcast. Streaming viewership encompasses live streaming of traditional television stations accessed through over-the-top platforms, creating a comprehensive picture of how Polish audiences consume television content.

Audience measurement focuses on individuals aged four years and older, providing demographic insights into viewing patterns across age groups. The Average Minute Rating system calculates audience share data on monthly intervals, offering consistent measurement standards for industry analysis and advertising planning purposes.

The "Other" category within Nielsen's classification system captures views of unrecognized content, accounting for 7.2% of total viewing time in August 2025. This classification helps identify consumption patterns that fall outside traditional broadcasting and established streaming platforms, potentially including user-generated content, gaming, or emerging digital services.

Platform distribution reflects viewing diversity

Cable television commanded the largest single share of Polish viewing time at 33.7% in August 2025. This substantial portion demonstrates the continued relevance of traditional cable infrastructure in Polish households, where bundled services often provide both internet connectivity and television programming.

Satellite broadcasting captured 30.1% of viewing time, representing the second-largest distribution method. Poland's satellite television market includes both domestic and international programming options, with viewers accessing content from multiple European markets through satellite technology.

Terrestrial television accounted for 23.5% of total viewing, reflecting the ongoing importance of free-to-air broadcasting in Poland. This distribution method provides essential programming access for households without cable or satellite subscriptions, maintaining its role in Poland's media ecosystem despite digital transformation trends.

The combined streaming category, at 9.7% of total viewing time, represents significant growth compared to previous measurement periods. However, this figure remains substantially below streaming penetration rates observed in other international markets, where platforms have achieved higher market share percentages.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Industry implications for marketing professionals

These viewing patterns create specific strategic considerations for marketing professionals operating in Poland's television advertising market. The stability of traditional television consumption, combined with streaming's measured growth, suggests a transitional period rather than immediate platform displacement.

Traditional television's continued dominance at over 87% of viewing time provides advertisers with substantial reach opportunities through established broadcasting networks. The concentration of viewership across TVP1, Republika, and Polsat creates clear targeting strategies for campaigns seeking maximum audience exposure within Poland's television ecosystem.

Streaming platform differentiation offers targeted advertising opportunities for brands seeking specific demographic segments. YouTube's 2.2% share primarily attracts younger demographics, while Netflix's 2.0% share typically skews toward urban, higher-income households. These distinctions enable precise campaign targeting based on platform-specific audience characteristics.

The seasonal variation in streaming consumption, evidenced by August's retreat from July's historic levels, suggests advertising budget allocation should account for temporal viewing pattern changes. Summer months may require adjusted streaming investment strategies as audiences shift between digital and traditional platform consumption.

Market context within European television trends

Poland's television consumption patterns reflect broader European market dynamics while maintaining distinct characteristics. The measured streaming growth contrasts with more aggressive digital adoption rates observed in Western European markets, where streaming services have captured larger viewing time percentages.

The prominence of political and cultural programming in driving traditional television viewing aligns with patterns observed across European markets, where significant events continue attracting audiences to established broadcasting networks. This trend suggests traditional television maintains relevance for communal viewing experiences and major cultural moments.

Netflix's growth trajectory in Poland, while modest compared to global performance, follows international expansion patterns where the platform gradually builds market share through content localization and subscriber acquisition strategies. The 0.2 percentage point monthly increase demonstrates steady progress within Poland's competitive streaming environment.

YouTube's slight decline from July to August, dropping 0.2 percentage points, may reflect seasonal viewing pattern adjustments rather than fundamental platform performance issues. The platform's maintained leadership position at 2.2% share indicates established user habits and content consumption preferences among Polish audiences.

Measurement evolution supports industry transformation

Nielsen Poland's implementation of The Gauge measurement system represents part of the company's broader international expansion of comprehensive television analytics. The methodology addresses industry demands for unified measurement across traditional and streaming platforms, providing consistent data for advertising decision-making.

The single-source panel approach enables cross-platform audience measurement, addressing fragmentation challenges that affect television advertising planning. This methodology provides advertisers with deduplicated audience reach calculations, ensuring accurate campaign performance assessment across multiple viewing platforms.

Time-shifted viewing measurement, capturing content consumption up to seven days after original broadcast, reflects changing viewer behavior patterns where audiences increasingly control when they consume television programming. This capability provides more accurate audience measurement for advertising campaigns targeting specific programming content.

The monthly reporting schedule aligns with advertising industry planning cycles while providing sufficient data granularity for campaign optimization decisions. Nielsen's consistency in methodology enables year-over-year performance comparisons and seasonal trend analysis for strategic planning purposes.

Technology integration drives measurement precision

Advanced measurement technologies support Nielsen Poland's comprehensive television analytics. Computer vision systems and automatic content recognition enable precise identification of viewed content across multiple platforms and distribution methods. These technologies address measurement challenges created by Poland's diverse television ecosystem.

Real-time data processing capabilities allow for monthly report generation while maintaining data accuracy standards required for advertising industry applications. The system processes viewing behavior from nearly 10,000 panelists to create representative samples of Poland's television consumption patterns.

Privacy protection measures ensure panelist data remains secure while providing industry-standard analytics. The opt-in participation model maintains compliance with European data protection requirements while enabling detailed viewing behavior analysis for market research purposes.

Integration capabilities support data sharing with advertising agencies and media planning organizations, enabling campaign targeting and performance measurement. These systems provide essential infrastructure for Poland's television advertising market as it adapts to multi-platform viewing environments.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Timeline

August 2024:

- Polish viewers spent average of 3 hours 31 minutes per day watching TV

- Olympic Games dominated top 10 most-watched programs

- Streaming captured 8.7% of total TV viewing

January 2024:

March 2024:

May 2021:

- Nielsen published its first edition of The Gauge in the U.S.

June 2025:

- Netflix achieved 8.3% of total TV usage while streaming hit 46% market share globally

- Tubi surpassed 100 million users during streaming advertising market expansion

July 2025:

- Polish streaming experienced "historic" levels (specific percentage not disclosed)

- YouTube captured 2.4% of total TV viewing

- Netflix held 1.8% share

- Comscore announced advanced measurement partnership with HyphaMetrics for Connected TV

August 2025:

- Polish viewers maintained 3 hours 31 minutes daily TV consumption (1 minute decrease from July)

- Streaming share decreased to 9.7%, returning to June levels

- YouTube declined to 2.2%, Netflix increased to 2.0%

- Traditional TV stations TVP1, Republika, and Polsat dominated viewership

- Sports and political events drove traditional channel viewing

- TVision published State of Streaming report showing content type affects attention rates

- Kargo CTV campaigns achieved 78% higher attention than industry standards

September 2025:

- Nielsen released The Gauge: Poland August 2025 report

- Nielsen launched big data + panel measurement system for enhanced TV analytics

- LG Ad Solutions released comprehensive diversity studies revealing CTV viewing patterns

- Index Exchange advanced duration-based metrics for streaming TV measurement

- Marketing models face challenges as Mixed Media Models fall short in measuring linear TV effectiveness

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: Polish television viewers aged 4+ years, measured through Nielsen's single-source panel of 3,500 households with nearly 9,700 panelists, consuming content across traditional TV networks (TVP1, Republika, Polsat) and streaming platforms (YouTube, Netflix, others).

What: Polish viewers maintained stable television consumption at 3 hours 31 minutes daily in August 2025, while streaming's share decreased to 9.7% from July's historic peak, returning to June levels. YouTube led streaming platforms at 2.2% share despite declining from 2.4%, while Netflix increased to 2.0% from 1.8%.

When: August 2025 measurement period, with Nielsen's The Gauge: Poland report published in September 2025, covering data from August 1-31, 2025.

Where: Poland's television market, measured across cable (33.7% share), satellite (30.1%), terrestrial broadcasting (23.5%), and streaming platforms (9.7%), with additional "other" category content (7.2%).

Why: Political and sports programming drew audiences to traditional channels, maintaining television's dominance while streaming experienced seasonal adjustments. The data reflects Poland's transitional media landscape where traditional broadcasting retains substantial market share despite gradual streaming growth, creating strategic implications for advertisers navigating multi-platform audience targeting.